NetSpend 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

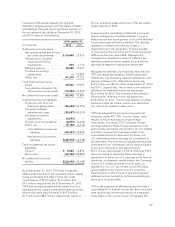

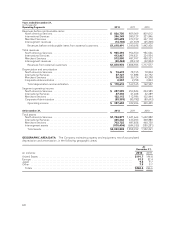

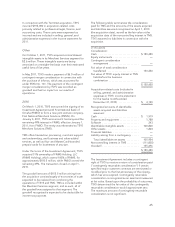

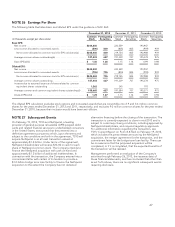

NOTE 26 Earnings Per Share

The following table illustrates basic and diluted EPS under the guidance of ASC 260:

December 31, 2012 December 31, 2011 December 31, 2010

(in thousands, except per share data)

Common

Stock Participating

Securities Common

Stock Participating

Securities Common

Stock Participating

Securities

Basic EPS:

Net income ................................................. $244,280 220,559 193,947

Less income allocated to nonvested awards ...................... (800) 800 (805) 805 (959) 959

Net income allocated to common stock for EPS calculation(a) ..... $243,480 800 219,754 805 192,988 959

Average common shares outstanding(b) ......................... 187,403 627 191,239 707 195,378 975

Basic EPS(a)/(b) .............................................. $ 1.30 1.28 1.15 1.14 0.99 0.98

Diluted EPS:

Net income ................................................. $244,280 220,559 193,947

Less income allocated to nonvested awards ...................... (796) 796 (804) 804 (959) 959

Net income allocated to common stock for EPS calculation(c) ..... $243,484 796 219,755 804 192,988 959

Average common shares outstanding ........................... 187,403 627 191,239 707 195,378 975

Increase due to assumed issuance of shares related to common

equivalent shares outstanding ............................... 1,262 345 193

Average common and common equivalent shares outstanding(d) .... 188,665 627 191,584 707 195,571 975

Diluted EPS(c)/(d) ............................................ $ 1.29 1.27 1.15 1.14 0.99 0.98

The diluted EPS calculation excludes stock options and nonvested awards that are convertible into 2.9 and 3.6 million common

shares for the years ended December 31, 2012 and 2011, respectively, and excludes 9.0 million common shares for the year ended

December 31, 2010, because their inclusion would have been anti-dilutive.

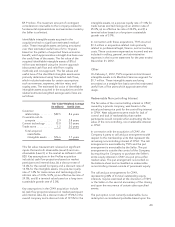

NOTE 27 Subsequent Events

On February 19, 2013, TSYS and NetSpend, a leading

provider of general purpose reloadable (GPR) prepaid debit

cards and related financial services to underbanked consumers

in the United States, announced that they entered into a

definitive agreement pursuant to which, upon the terms and

subject to the conditions set forth in the agreement, TSYS will

acquire NetSpend in an all cash transaction valued at

approximately $1.4 billion. Under terms of the agreement,

NetSpend shareholders will receive $16.00 in cash for each

share of NetSpend common stock. The Company intends to

finance the NetSpend acquisition with cash on hand and

approximately $1.3 billion of additional indebtedness. In

connection with the transaction, the Company entered into a

commitment letter with certain of its lenders to provide a

$1.2 billion bridge term loan facility to finance the NetSpend

acquisition to the extent the Company has not obtained

alternative financing before the closing of the transaction. The

transaction is currently expected to close in mid-2013 and is

subject to customary closing conditions, including approval by

NetSpend shareholders, and required regulatory approvals.

For additional information regarding the transaction, see

TSYS’ Current Report on Form 8-K filed on February 19, 2013,

which includes the press release announcing the NetSpend

acquisition, the merger agreement for the transaction, and the

commitment letter for the bridge term loan facility. There can

be no assurance that the proposed acquisition will be

completed, or if it is completed, that the expected benefits of

the transaction will be realized.

Management performed an evaluation of the Company’s

activities through February 26, 2013, the issuance date of

these financial statements, and has concluded that other than

as set forth above, there are no significant subsequent events

requiring disclosure.

67