NetSpend 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

250,000 merchants to instantly self-enroll online, and offer

simplified pricing and the ability to accept a payment from their

mobile or smart devices with secure processing and encryption.

In July 2012, we announced a new long-term agreement with

Bank of America

®

Corp. to begin processing for its U.S. consumer

credit card portfolio and continue providing processing for its

commercial card portfolio. This type of event debunks the theory

that I’ve heard over the years, which is that the largest issuers feel

they must process in-house. Personally, I believe that TSYS clients

find themselves in an advantageous position, not only technically,

but also in terms of customer service, product development and

compliance when compared with their in-house competitors.

Additionally, in August, we announced the formation of a

60-percent-owned joint venture with Central Payment

®

Co., LLC,

one of the fastest-growing private companies in the United States.*

Central Payment, based in San Rafael, Calif., has more than 800

independent sales agents, supporting some 45,000 merchants in

the restaurant, personal services and retail sectors. This joint venture

will help move us closer to our goal of becoming a top-10 global

acquirer in terms of revenues and profits.

2012 PERFORMANCE

We feel that it’s important to have clear performance standards.

Without them, goals become moving targets and bull’s-eyes

can be painted wherever the arrow lands. The Board of Directors

and I measure our financial performance by looking at revenue

growth and operational performance of our businesses and the

individuals that run them.

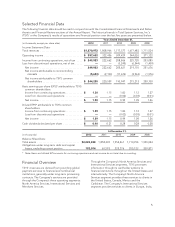

Overall, our company’s progress in 2012 was very good, as we

met revenue and earnings-per-share (EPS) expectations, and had

exceptionally strong performance for the year. We had double-

digit operating income growth of 10.9 percent year over year. Our

basic earnings per share was $1.30, an increase of 13.1 percent

year over year. Total revenues were $1.9 billion, up 3.4 percent.

Once we convert Bank of America, which we expect to occur

in 2014, and continue our worldwide growth, we’ll be close to

our goal of being the largest third-party processor of Visa and

MasterCard credit cards. We as a leadership team are confident

that we’re headed in the right direction.

We also saw good increases in transactions in 2012. Transactions

from our issuer-processing business were up 13.1 percent over

last year, and point-of-sale (POS) transactions from our merchant-

processing business were up 10.7 percent, excluding Bank of

America Merchant Services. Same-client transactions were up 12.2

percent in our North America segment and 11.0 percent for Interna-

tional. In our direct merchant business, our sales volume increased

15.6 percent year over year. Part of that increase can be attributed

to our new Central Payment joint venture and a full year of reporting

from our 2011 acquisition of TermNet Merchant Services.

A REVIEW OF OUR SEGMENTS

Let’s examine the performance of our three reporting segments:

North America, International and Merchant Services. I’d like to take a

moment to share the segments’ highlights, along with the strengths

and challenges unique to each.

NORTH AMERICA SERVICES:

In this segment, we were

buoyed by our long-term contracts and the recurring revenue they

provide. Our revenue from this segment was $965.4 million, an

increase of 1.1 percent year over year. The North America seg-

ment represents approximately 51 percent of TSYS’ consolidated

revenue. We gained traction with community banks, regional banks

and credit unions by packaging TS2

®

—

one of our core processing

platforms

—

with risk, marketing and consulting services, tuning into

the individual needs for this market sector. This package of services

harnesses the powerful financial technology used by many of the

largest banks, giving smaller institutions the power to compete

successfully. Regional banks are re-entering the business in an

aggressive way, buying back portfolios and re-establishing them-

selves in the credit card market. We think this bodes well for TSYS.

As growth in mobile wallets becomes more mainstream, we will

continue pursuing opportunities with mobile wallet providers to

deliver our clients’ customers a safe, secure payment experience.

To further enhance the customers’ experience, we began offering

transaction-based marketing funded by participating merchants that

target the individual’s spend behavior. Traditionally, our business

was all about completing the transaction, but these days, real value

also lies in all that happens before, during and after it.

INTERNATIONAL SERVICES:

Those of you who follow

our International segment know that we’ve taken a close look at

our margins. It is our goal to increase our international margins

300 to 400 basis points per year (beginning in 2013) until we reach

a margin goal of 18 to 20 percent. Our plan includes expense

reductions, cross-selling opportunities and top-line growth.

During the past year, we made the decision to segregate

supporting services

—

such as technology, client support and

operations

—

domestically and internationally. We’ve also been

realigning resources to encourage accountability, eliminate

non-performing assets and increase scale where we do business.

* Inc. Magazine’s Top 500 fastest-growing companies

2

TSYS accelerated its growth of processing of accounts, establishing valuable

relationships and becoming a bigger player in the field. (s)

The development and launch of TS takes the company to

new heights and furthered its reputation throughout the

industry as the “gold standard” of processing platforms. ()