LinkedIn 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

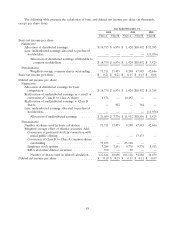

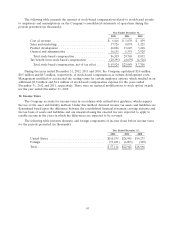

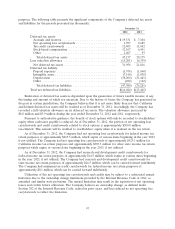

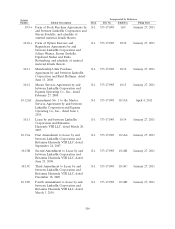

purposes. The following table presents the significant components of the Company’s deferred tax assets

and liabilities for the periods presented (in thousands):

December 31,

2012 2011

Deferred tax assets:

Accruals and reserves ............................... $19,531 $ 7,104

Net operating loss carryforwards ....................... 1,707 2,685

Tax credit carryforwards ............................. 12,405 11,842

Stock-based compensation ............................ 12,107 6,451

Other .......................................... 1,407 93

Total deferred tax assets ........................... 47,157 28,175

Less valuation allowance .............................. (15,201) (6,359)

Net deferred tax assets .............................. 31,956 21,816

Deferred tax liability:

Prepaid expenses .................................. (1,974) (1,860)

Intangible assets ................................... (7,518) (1,838)

Depreciation ..................................... (38,206) (31,441)

Other .......................................... (282) (122)

Total deferred tax liabilities ......................... (47,980) (35,261)

Total net deferred tax liabilities .......................... $(16,024) $(13,445)

Realization of deferred tax assets is dependent upon the generation of future taxable income, if any,

the timing and amount of which are uncertain. Due to the history of losses the Company has generated in

the past in certain jurisdictions, the Company believes that it is not more likely than not that California

and Ireland deferred tax assets will be realized as of December 31, 2012. Accordingly, the Company has

recorded a full valuation allowance on its deferred tax assets. The valuation allowance increased by

$8.8 million and $3.9 million during the year ended December 31, 2012 and 2011, respectively.

Pursuant to authoritative guidance, the benefit of stock options will only be recorded to stockholders’

equity when cash taxes payable is reduced. As of December 31, 2012, the portion of net operating loss

carryforwards and credit carryforwards related to stock options is approximately $200.0 million

tax-effected. This amount will be credited to stockholders’ equity when it is realized on the tax return.

As of December 31, 2012, the Company had net operating loss carryforwards for federal income tax

return purposes of approximately $465.3 million, which expire at various dates beginning in the year 2023,

if not utilized. The Company had net operating loss carryforwards of approximately $529.1 million for

California income tax return purposes and approximately $385.3 million for other state income tax return

purposes which expire at various dates beginning in the year 2013, if not utilized.

As of December 31, 2012, the Company had research and development credit carryforwards for

federal income tax return purposes of approximately $14.5 million, which expire at various dates beginning

in the year 2023, if not utilized. The Company had research and development credit carryforwards for

state income tax return purposes of approximately $26.5 million, which can be carried forward indefinitely.

The Company had minimum tax credit carryforwards for federal income tax return purposes of

approximately $0.1 million, which can be carried forward indefinitely.

Utilization of the net operating loss carryforwards and credits may be subject to a substantial annual

limitation due to the ownership change limitations provided by the Internal Revenue Code of 1986, as

amended and similar state provisions. The annual limitation may result in the expiration of net operating

losses and credits before utilization. The Company believes an ownership change, as defined under

Section 382 of the Internal Revenue Code, existed in prior years, and has reduced its net operating loss

carryforwards to reflect the limitation.

97