LinkedIn 2012 Annual Report Download - page 66

Download and view the complete annual report

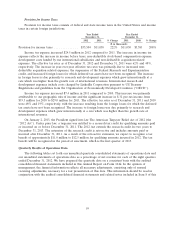

Please find page 66 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.receivable was primarily due to our revenue growth in 2010 as compared to 2009. The increase in

accounts payable and accrued liabilities reflects timing of payments due to the growth in our business

activities. We had net income in 2010 of $15.4 million, which included non-cash depreciation and

amortization of $19.6 million and non-cash stock-based compensation of $8.8 million.

Investing Activities

Our primary investing activities have consisted of purchases of investments, purchases of property and

equipment specifically related to the build out of our data centers, as well as payments for intangible

assets and strategic acquisitions. We also continued to invest in technology hardware to support our

growth, software to support website functionality development, website operations and our corporate

infrastructure. Purchases of property and equipment may vary from period to period due to the timing of

the expansion of our operations and website and internal-use software development. We expect to

continue to invest in property and equipment and development of software in 2013. Our planned

purchases of property and equipment for 2013 are expected to be approximately $215.0 million.

In 2012, we had net purchases of investments of $245.5 million, purchases of property and equipment

of $125.4 million, and made payments for intangible assets and acquisitions, net of cash acquired, of

$57.0 million. In 2011, we had net purchases of investments of $239.4 million, purchases of property and

equipment of $89.0 million, and made payments for intangible assets and acquisitions, net of cash

acquired, of $7.4 million. In 2010, we had purchases of property and equipment of $50.0 million.

Financing Activities

Our financing activities in 2012 have consisted primarily of net proceeds from the issuance of

common stock from employee option exercises and stock purchase plan, as well as the excess tax benefit

from the exercise of stock options.

Our financing activities in 2011 consisted primarily of $426.5 million in proceeds from our IPO and

follow-on offering, net of offering costs. Our financing activities in 2011 also included net proceeds from

the issuance of common stock from employee option exercises. We did not have significant financing

activities in 2010.

Off Balance Sheet Arrangements

We did not have any off balance sheet arrangements in 2012, 2011 or 2010.

Contractual Obligations

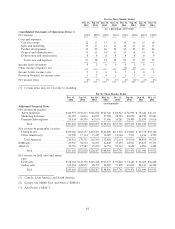

We lease office space for our headquarters in Mountain View, California under operating leases that

we expect to expire in 2023. We lease other facilities around the world, including office space in

Sunnyvale, California, to be constructed by our landlord, the longest of which expires in 2026. We have

several material long-term purchase obligations outstanding with third parties. We do not have any debt or

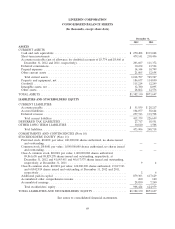

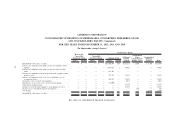

material capital lease obligations. As of December 31, 2012, the following table summarizes our

64