LinkedIn 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Early Exercise of Stock Options

The Company typically allows employees to exercise options granted under the 2003 Plan prior to

vesting. The unvested shares are subject to the Company’s repurchase right at the original purchase price.

The proceeds initially are recorded as an accrued liability from the early exercise of stock options (see

Note 7, Accrued Liabilities), and reclassified to common stock as the Company’s repurchase right lapses.

The Company issued common stock of approximately 6,000 and 980,000 shares during the years ended

December 31, 2012 and 2011, respectively, for stock options exercised prior to vesting. During the years

ended December 31, 2012 and 2011, the Company repurchased 85,009 and 21,830 shares, respectively, of

common stock related to unvested stock options, at the original exercise price due to the termination of

employees. At December 31, 2012 and 2011, 223,322 and 789,137 shares held by employees and directors

were subject to repurchase at an aggregate price of $1.3 million and $4.8 million, respectively.

Employee Stock Purchase Plan

Concurrent with the effectiveness of the Company’s registration statement on Form S-1 on May 18,

2011, the Company’s 2011 Employee Stock Purchase Plan (the ‘‘ESPP’’) became effective. The ESPP

allows eligible employees to purchase shares of the Company’s Class A common stock at a discount

through payroll deductions of up to 10% of their eligible compensation, subject to any plan limitations.

The ESPP provides for six-month offering periods, and at the end of each offering period, employees are

able to purchase shares at 85% of the lower of the fair market value of the Company’s Class A common

stock on the first trading day of the offering period or on the last day of the offering period.

Employees purchased 232,994 shares of common stock at an average exercise price of $72.37 in fiscal

2012. As of December 31, 2012, approximately 3,102,639 shares remained available for future issuance.

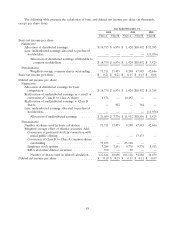

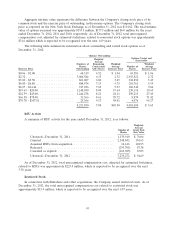

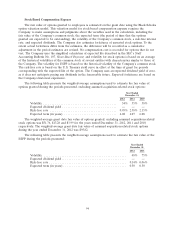

Stock Option Activity

A summary of stock option activity for the year ended December 31, 2012 is as follows:

Weighted-

Average

Options Outstanding Remaining Aggregate

Weighted- Contractual Intrinsic

Number of Average Term Value

Shares Exercise Price (in years) (in thousands)

Outstanding—December 31, 2011 .............. 14,784,701 $ 9.35

Assumed options from acquisition .............. 82,108 9.46

Granted ................................. 13,270 101.61

Exercised ................................ (5,864,624) 7.58

Canceled or expired ........................ (763,605) 12.12

Outstanding—December 31, 2012 .............. 8,251,850 $ 10.50 7.08 $860,820

Options vested and expected to vest as of

December 31, 2012 ....................... 7,897,225 $ 10.14 7.04 $826,667

Options vested and exercisable as of December 31,

2012 .................................. 4,081,688 $ 5.63 6.49 $445,679

92