LinkedIn 2012 Annual Report Download - page 92

Download and view the complete annual report

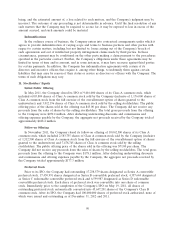

Please find page 92 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.being, and the estimated amount of, a loss related to such matters, and the Company’s judgment may be

incorrect. The outcome of any proceeding is not determinable in advance. Until the final resolution of any

such matters that the Company may be required to accrue for, it may be exposed to loss in excess of the

amount accrued, and such amounts could be material.

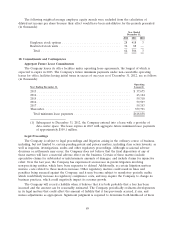

Indemnifications

In the ordinary course of business, the Company enters into contractual arrangements under which it

agrees to provide indemnification of varying scope and terms to business partners and other parties with

respect to certain matters, including, but not limited to, losses arising out of the Company’s breach of

such agreements and out of intellectual property infringement claims made by third parties. In these

circumstances, payment may be conditional on the other party making a claim pursuant to the procedures

specified in the particular contract. Further, the Company’s obligations under these agreements may be

limited in terms of time and/or amount, and in some instances, it may have recourse against third parties

for certain payments. In addition, the Company has indemnification agreements with certain of its

directors and executive officers that require it, among other things, to indemnify them against certain

liabilities that may arise by reason of their status or service as directors or officers with the Company. The

terms of such obligations may vary.

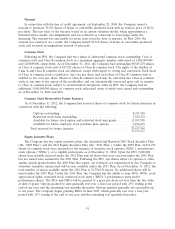

11. Stockholders’ Equity

Initial Public Offering

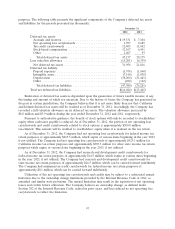

In May 2011, the Company closed its IPO of 9,016,000 shares of its Class A common stock, which

included 6,003,804 shares of Class A common stock sold by the Company (inclusive of 1,176,000 shares of

Class A common stock from the full exercise of the overallotment option of shares granted to the

underwriters) and 3,012,196 shares of Class A common stock sold by the selling stockholders. The public

offering price of the shares sold in the offering was $45.00 per share. The Company did not receive any

proceeds from the sales of shares by the selling stockholders. The total gross proceeds from the offering

to the Company were $270.2 million. After deducting underwriting discounts and commissions and

offering expenses payable by the Company, the aggregate net proceeds received by the Company totaled

approximately $248.4 million.

Follow-on Offering

In November 2011, the Company closed its follow-on offering of 10,062,500 shares of its Class A

common stock, which included 2,583,755 shares of Class A common stock sold by the Company (inclusive

of 1,312,500 shares of Class A common stock from the full exercise of the overallotment option of shares

granted to the underwriters) and 7,478,745 shares of Class A common stock sold by the selling

stockholders. The public offering price of the shares sold in the offering was $71.00 per share. The

Company did not receive any proceeds from the sales of shares by the selling stockholders. The total gross

proceeds from the offering to the Company were $178.1 million. After deducting underwriting discounts

and commissions and offering expenses payable by the Company, the aggregate net proceeds received by

the Company totaled approximately $177.3 million.

Preferred Stock

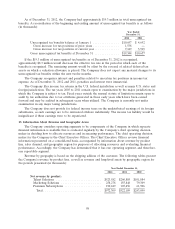

Prior to its IPO, the Company had outstanding 17,238,579 shares designated as Series A convertible

preferred stock, 17,450,991 shares designated as Series B convertible preferred stock, 4,357,644 designated

as Series C redeemable convertible preferred stock and 6,599,987 designated as Series D redeemable

convertible preferred stock. Each share of preferred stock was convertible into one share of common

stock. Immediately prior to the completion of the Company’s IPO on May 19, 2011, all shares of

outstanding preferred stock automatically converted into 45,647,201 shares of the Company’s Class B

common stock. After its IPO, the Company had 100,000,000 shares of preferred stock authorized, none of

which were issued and outstanding as of December 31, 2012 and 2011.

90