LinkedIn 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

The Company records income taxes using the asset and liability method which requires the

recognition of deferred tax assets and liabilities for the expected future tax consequences of events that

have been recognized in the Company’s consolidated financial statements or tax returns. In estimating

future tax consequences, generally all expected future events other than enactments or changes in the tax

law or rates are considered. Valuation allowances are provided when necessary to reduce deferred tax

assets to the amount expected to be realized.

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than

not the tax position will be sustained on examination by the taxing authorities, based on the technical

merits of the position. The tax benefits recognized in the financial statements from such positions are then

measured based on the largest benefit that has a greater than 50% likelihood of being realized upon

settlement. For further information, see Note 12, Income Taxes.

Recently Adopted Accounting Guidance

Comprehensive Income

In June 2011, the FASB issued new authoritative guidance on comprehensive income that eliminates

the option to present the components of other comprehensive income as part of the statement of

shareholders’ equity. Instead, the Company must report comprehensive income in either a single

continuous statement of comprehensive income which contains two sections, net income and other

comprehensive income, or in two separate but consecutive statements. In December 2011, the requirement

regarding the presentation of reclassification adjustments out of accumulated other comprehensive income

was deferred indefinitely. The Company adopted this authoritative guidance in its interim period

March 31, 2012.

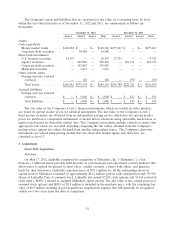

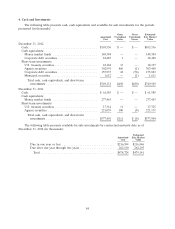

2. Fair Value Measurements

The Company measures assets and liabilities at fair value based on an expected exit price as defined

by the authoritative guidance on fair value measurements, which represents the amount that would be

received on the sale of an asset or paid to transfer a liability, as the case may be, in an orderly transaction

between market participants. As such, fair value may be based on assumptions that market participants

would use in pricing an asset or liability. The authoritative guidance on fair value measurements

establishes a consistent framework for measuring fair value on either a recurring or nonrecurring basis

whereby inputs, used in valuation techniques, are assigned a hierarchical level. The following are the

hierarchical levels of inputs to measure fair value:

• Level 1: Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities

in active markets.

• Level 2: Inputs reflect: quoted prices for identical assets or liabilities in markets that are not

active; quoted prices for similar assets or liabilities in active markets; inputs other than quoted

prices that are observable for the assets or liabilities; or inputs that are derived principally from or

corroborated by observable market data by correlation or other means.

• Level 3: Unobservable inputs reflecting the Company’s assumptions incorporated in valuation

techniques used to determine fair value. These assumptions are required to be consistent with

market participant assumptions that are reasonably available.

80