LinkedIn 2012 Annual Report Download - page 79

Download and view the complete annual report

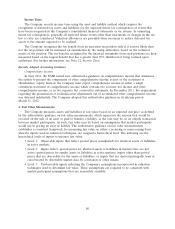

Please find page 79 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.amortization of deferred commissions is included in sales and marketing expense in the accompanying

consolidated statements of operations.

Derivative Financial Instruments

The Company enters into foreign currency derivative contracts with financial institutions to reduce

the risk that its cash flows and earnings will be adversely affected by foreign currency exchange rate

fluctuations. The Company’s foreign currency derivative contracts, which are not designated as hedging

instruments, are used to reduce the exchange rate risk associated with its foreign currency denominated

monetary assets and liabilities. The Company’s program is not designated for trading or speculative

purposes. The foreign currency derivative contracts that were not settled as of December 31, 2012 and

2011 are recorded at fair value in the consolidated balance sheets. Foreign currency derivative contracts

are marked-to-market at the end of each reporting period and the related gains and losses are recognized

in other income (expense), net in the accompanying consolidated statements of operations to offset the

gains or losses of the related hedged items. The Company recognized a net realized and unrealized loss of

$2.2 million in 2012 and an immaterial net realized and unrealized gain in 2011 on its foreign currency

forward contracts. The Company did not have any foreign currency derivative contracts in 2010. As of

December 31, 2012 and 2011, we had outstanding foreign currency forward contracts with a total notional

amount of $83.5 million and $34.1 million, respectively.

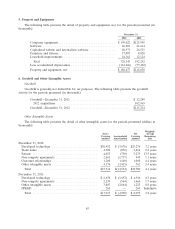

Property and Equipment

Property and equipment are stated at cost, less accumulated depreciation and amortization.

Depreciation and amortization is computed using the straight-line method over the estimated useful lives

of the assets, which range from two to five years. Leasehold improvements are amortized over the shorter

of the lease term or expected useful lives of the improvements. Depreciation expense totaled

$70.0 million, $39.5 million and $18.6 million for the years ended December 31, 2012, 2011 and 2010,

respectively.

Website and Internal-Use Software Development Costs

The Company capitalizes its costs to develop its website and internal-use software when preliminary

development efforts are successfully completed, management has authorized and committed project

funding, and it is probable that the project will be completed and the software will be used as intended.

Such costs are amortized on a straight-line basis over the estimated useful life of the related asset, which

approximates two to three years. Costs incurred prior to meeting these criteria, together with costs

incurred for training and maintenance, are expensed as incurred.

The Company capitalized website and internal-use software costs of $20.0 million, $10.9 million and

$6.4 million for the years ended December 31, 2012, 2011 and 2010, respectively. The Company’s

capitalized website and internal-use software amortization is included in depreciation and amortization in

the Company’s consolidated statements of operations, and totaled $11.2 million, $5.4 million and

$2.9 million for the years ended December 31, 2012, 2011 and 2010, respectively. The Company had

unamortized capitalized website and internal-use software of $20.7 million and $12.0 million in the

consolidated balance sheets as of December 31, 2012 and 2011, respectively.

Goodwill, Intangible Assets, Long-Lived Assets and Impairment Assessments

Goodwill. Goodwill represents the excess of the purchase price of an acquired business over the fair

value of the underlying net tangible and intangible assets. Goodwill is evaluated for impairment annually

in the third quarter of the Company’s fiscal year, and whenever events or changes in circumstances

indicate the carrying value of goodwill may not be recoverable. Triggering events that may indicate

impairment include, but are not limited to, a significant adverse change in customer demand or business

climate that could affect the value of goodwill or a significant decrease in expected cash flows. Through

December 31, 2012, no impairment of goodwill has been identified.

77