LinkedIn 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.price method in accordance with the selling price hierarchy. The objective of the hierarchy is to determine

the price at which we would transact a sale if the service were sold on a stand-alone basis and requires

the use of: (i) vendor-specific objective evidence (‘‘VSOE’’) if available; (ii) third-party evidence (‘‘TPE’’)

if VSOE is not available; and (iii) best estimate of selling price (‘‘BESP’’) if neither VSOE nor TPE is

available.

VSOE. The Company determines VSOE based on its historical pricing and discounting practices for

the specific product or service when sold separately. In determining VSOE, the Company requires that a

substantial majority of the selling prices for these services fall within a reasonably narrow pricing range.

The Company has not historically priced its Marketing Solutions or certain products of its Talent

Solutions within a narrow range. As a result, the Company has only used VSOE to allocate the selling

price of deliverables in limited circumstances.

TPE. When VSOE cannot be established for deliverables in multiple element arrangements, the

Company applies judgment with respect to whether it can establish a selling price based on TPE. TPE is

determined based on competitor prices for similar deliverables when sold separately. Generally, the

Company’s go-to-market strategy differs from that of its peers and its offerings contain a significant level

of differentiation such that the comparable pricing of services with similar functionality cannot be

obtained. Furthermore, the Company is unable to reliably determine what similar competitor services’

selling prices are on a stand-alone basis. As a result, the Company has not been able to establish selling

price based on TPE.

BESP. When it is unable to establish selling price using VSOE or TPE, the Company uses BESP in

its allocation of arrangement consideration. BESP is generally used to allocate the selling price to

deliverables in the Company’s multiple element arrangements. The Company determines BESP for

deliverables by considering multiple factors including, but not limited to, its pricing practices, prices it

charges for similar offerings, sales volume, geographies, market conditions, and the competitive landscape.

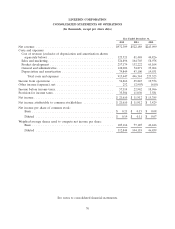

Advertising Costs

Advertising costs are expensed when incurred and are included in sales and marketing expense in the

accompanying consolidated statements of operations. The Company incurred advertising costs of

$3.6 million, $2.4 million and $0.7 million for the years ended December 31, 2012, 2011 and 2010,

respectively.

Stock-Based Compensation

Stock-based compensation expense is measured at the grant date based on the fair value of the award

and is recognized on a straight-line basis over the requisite service period of the award, which is generally

four years.

Leases

The Company leases its office facilities under operating lease agreements. Office facilities subject to

an operating lease and the related lease payments are not recorded on the Company’s balance sheet. The

terms of certain lease agreements provide for rental payments on a graduated basis, however, the

Company recognizes rent expense on a straight-line basis over the lease period in accordance with

authoritative accounting guidance. Any lease incentives are recognized as reductions of rental expense on

a straight-line basis over the term of the lease. The lease term begins on the date the Company becomes

legally obligated for the rent payments or when the Company takes possession of the office space,

whichever is earlier.

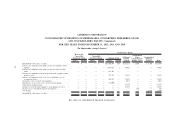

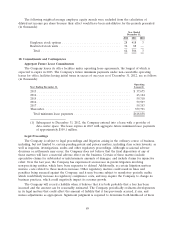

Rental expense, principally for leased office space under operating lease commitments, was

$30.7 million, $10.1 million and $4.0 million for the years ended December 31, 2012, 2011 and 2010,

respectively.

79