LinkedIn 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

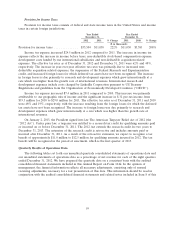

We record income taxes using the asset and liability method, which requires the recognition of

deferred tax assets and liabilities for the expected future tax consequences of events that have been

recognized in our financial statements or tax returns. In estimating future tax consequences, generally all

expected future events other than enactments or changes in the tax law or rates are considered. Valuation

allowances are provided when necessary to reduce deferred tax assets to the amount expected to be

realized.

We recognize a tax benefit from an uncertain tax position only if it is more likely than not the tax

position will be sustained on examination by the taxing authorities, based on the technical merits of the

position. The tax benefits recognized in the financial statements from such positions are then measured

based on the largest benefit that has a greater than 50% likelihood of being realized upon settlement. In

the event that any unrecognized tax benefits are recognized, the effective tax rate will be affected. If

recognized, approximately $8.3 million of unrecognized tax benefit would impact the effective tax rate at

December 31, 2012. Although we believe our estimates are reasonable, no assurance can be given that the

final tax outcome of these matters will be the same as these estimates. These estimates are updated

quarterly based on factors such as change in facts or circumstances, changes in tax law, new audit activity,

and effectively settled issues.

We follow specific and detailed guidelines in each tax jurisdiction regarding the recoverability of any

tax assets recorded on the balance sheet and provide necessary valuation allowances as required. Future

realization of deferred tax assets ultimately depends on the existence of sufficient taxable income of the

appropriate character (for example, ordinary income or capital gain) within the carryback or carryforward

periods available under the tax law. We regularly review our deferred tax assets for recoverability based

on historical taxable income, projected future taxable income, the expected timing of the reversals of

existing temporary differences and tax planning strategies. Our judgments regarding future profitability

may change due to many factors, including future market conditions and our ability to successfully execute

our business plans and/or tax planning strategies. Should there be a change in our ability to recover our

deferred tax assets, our tax provision would increase or decrease in the period in which the assessment is

changed.

Legal Contingencies

We are subject to legal proceedings and litigation arising in the ordinary course of business.

Periodically, we evaluate the status of each legal matter and assess our potential financial exposure. If the

potential loss from any legal proceeding or litigation is considered probable and the amount can be

reasonably estimated, we accrue a liability for the estimated loss. Significant judgment is required to

determine the probability of a loss and whether the amount of the loss is reasonably estimable. The

outcome of any proceeding is not determinable in advance. As a result, the assessment of a potential

liability and the amount of accruals recorded are based only on the information available at the time. As

additional information becomes available, we reassess the potential liability related to the legal proceeding

or litigation, and may revise our estimates. Any revisions could have a material effect on our results of

operations. See Note 10 of the Notes to the Consolidated Financial Statements under Item 8 for further

information on our legal proceedings and litigation.

Recently Issued Accounting Pronouncements

Comprehensive Income

In June 2011, the FASB issued new authoritative guidance on comprehensive income that eliminates

the option to present the components of other comprehensive income as part of the statement of

shareholders’ equity. Instead, we must report comprehensive income in either a single continuous

statement of comprehensive income which contains two sections, net income and other comprehensive

52