LinkedIn 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

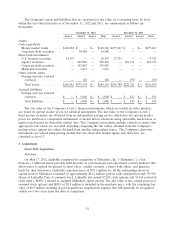

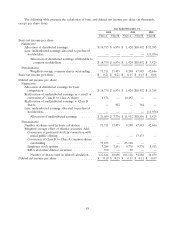

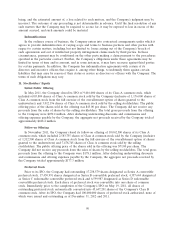

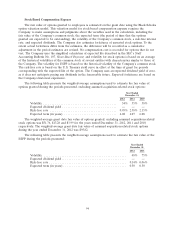

The following table presents the calculation of basic and diluted net income per share (in thousands,

except per share data):

Year Ended December 31,

2012 2011 2010

Class A Class B Class A Class B Class B

Basic net income per share:

Numerator:

Allocation of distributed earnings ................ $ 14,735 $ 6,874 $ 1,420 $10,492 $ 15,385

Less: undistributed earnings allocated to preferred

stockholders ............................. — — — — (11,956)

Allocation of distributed earnings attributable to

common stockholders ................... $ 14,735 $ 6,874 $ 1,420 $10,492 $ 3,429

Denominator:

Weighted-average common shares outstanding . . . 71,711 33,455 9,200 67,985 42,446

Basic net income per share ........................ $ 0.21 $ 0.21 $ 0.15 $ 0.15 $ 0.08

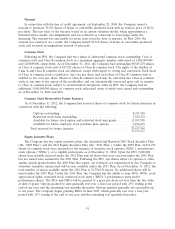

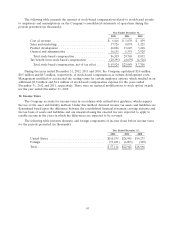

Diluted net income per share:

Numerator:

Allocation of distributed earnings for basic

computation ............................. $ 14,735 $ 6,874 $ 1,420 $10,492 $ 15,385

Reallocation of undistributed earnings as a result of

conversion of Class B to Class A shares ......... 6,874 — 10,492 — —

Reallocation of undistributed earnings to Class B

shares .................................. — 902 — 364 —

Less: undistributed earnings allocated to preferred

stockholders ............................. — — — — (11,956)

Allocation of undistributed earnings .......... $ 21,609 $ 7,776 $ 11,912 $10,856 $ 3,429

Denominator:

Number of shares used in basic calculation ......... 71,711 33,455 9,200 67,985 42,446

Weighted average effect of dilutive securities Add:

Conversion of preferred stock in connection with

initial public offering ..................... — — — 17,133 —

Conversion of Class B to Class A common shares

outstanding ............................ 33,455 — 85,118 — —

Employee stock options ..................... 7,288 7,151 9,770 9,770 4,013

RSUs and other dilutive securities ............. 390 — 30 — —

Number of shares used in diluted calculation .... 112,844 40,606 104,118 94,888 46,459

Diluted net income per share ...................... $ 0.19 $ 0.19 $ 0.11 $ 0.11 $ 0.07

88