LinkedIn 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

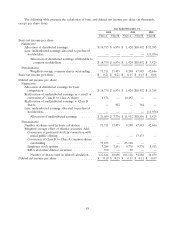

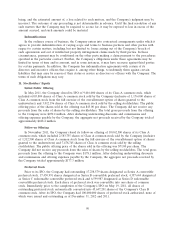

Aggregate intrinsic value represents the difference between the Company’s closing stock price of its

common stock and the exercise price of outstanding, in-the-money options. The Company’s closing stock

price as reported on the New York Stock Exchange as of December 31, 2012 was $114.82. The total intrinsic

value of options exercised was approximately $553.5 million, $177.5 million and $6.0 million for the years

ended December 31, 2012, 2011 and 2010, respectively. As of December 31, 2012, total unrecognized

compensation cost, adjusted for estimated forfeitures, related to nonvested stock options was approximately

$31.6 million which is expected to be recognized over the next 1.69 years.

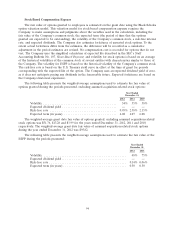

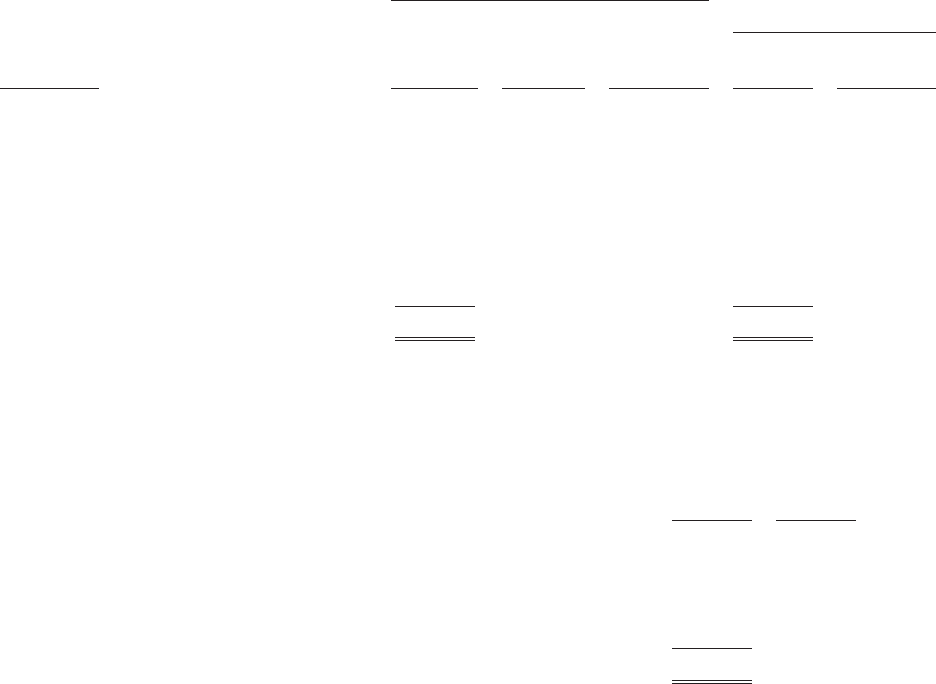

The following table summarizes information about outstanding and vested stock options as of

December 31, 2012:

Options Outstanding

Options Vested and

Weighted Exercisable

Average

Numbers of Remaining Weighted Weighted

Shares Contractual Average Number of Average

Exercise Price Outstanding Life (Years) Exercise Price Shares Exercise Price

$0.06 - $2.00 ..................... 68,519 4.52 $ 1.04 65,581 $ 1.06

$2.32 ........................... 3,066,584 6.15 2.32 2,915,821 2.32

$3.00 - $3.50 ..................... 861,087 6.80 3.49 218,898 3.49

$4.80 - $6.80 ..................... 888,474 7.13 5.75 201,761 5.59

$8.27 - $14.46 .................... 917,926 7.69 9.93 186,348 9.84

$19.63 - $20.00 .................... 1,148,050 8.09 19.64 230,114 19.63

$22.59 - $45.00 .................... 1,244,278 8.21 28.11 250,215 27.49

$66.38 - $78.08 .................... 31,566 8.61 70.72 8,874 71.42

$78.70 - $107.81 ................... 25,366 9.13 98.41 4,076 96.27

8,251,850 7.08 $10.50 4,081,688 $ 5.63

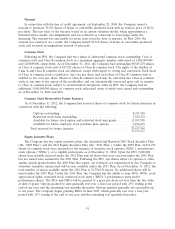

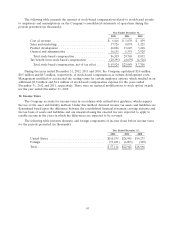

RSU Activity

A summary of RSU activity for the year ended December 31, 2012, is as follows:

Weighted-

Average

Number of Grant Date

Shares Fair Value

Unvested—December 31, 2011 ......................... 1,139,910 $ 76.04

Granted ......................................... 2,548,842 101.63

Assumed RSUs from acquisition ....................... 14,146 104.95

Released ......................................... (293,701) 87.38

Canceled or expired ................................ (169,925) 87.05

Unvested—December 31, 2012 ......................... 3,239,272 $ 94.69

As of December 31, 2012, total unrecognized compensation cost, adjusted for estimated forfeitures,

related to RSUs was approximately $225.4 million, which is expected to be recognized over the next

3.38 years.

Restricted Stock

In connection with Slideshare and other acquisitions, the Company issued restricted stock. As of

December 31, 2012, the total unrecognized compensation cost related to restricted stock was

approximately $15.9 million, which is expected to be recognized over the next 1.07 years.

93