LinkedIn 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The acquisition has been accounted for under the acquisition method and, accordingly, the total

purchase price has been allocated to the tangible and intangible assets acquired and the liabilities assumed

based on their respective fair values on the acquisition date. Slideshare’s results of operations have been

included in the consolidated financial statements from the date of acquisition. To retain the services of

certain former Slideshare employees, LinkedIn offered nonvested Class A common stock and cash

bonuses that will be earned in equal semi-annual installments over two years from the date of acquisition.

As these equity awards and payments are subject to post-acquisition employment, the Company is

accounting for these arrangements as post-acquisition compensation expense. In connection with these

post-acquisition arrangements, the Company issued 198,915 shares of non-vested Class A common stock

with a total fair value of $20.9 million and could pay retention bonuses up to $17.0 million.

Other acquisitions

In 2012, the Company completed five other acquisitions for total cash consideration of approximately

$28.3 million, subject to the finalization of deferred taxes, and 297,515 shares of LinkedIn Class A

common stock. As of December 31, 2012, $0.2 million remains to be paid in cash subject to the

satisfaction of certain general representations and warranties. The total purchase price of these

acquisitions, of which two were accounted for as the purchase of an asset and the others as purchases of

businesses under the acquisition method, has been allocated to the tangible and identifiable intangible

assets acquired and the net liabilities assumed based on their respective fair values on the acquisition

date.

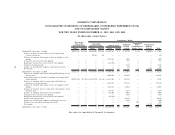

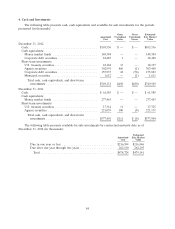

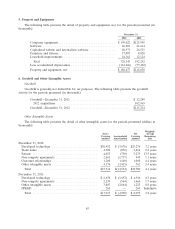

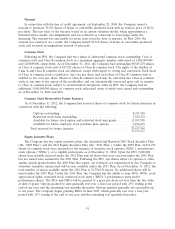

The following table presents the purchase price allocations initially recorded in the Company’s

consolidated balance sheets on the respective acquisition dates (in thousands):

Other

Slideshare Acquisitions Total

Net tangible assets (liabilities) ................. $ 3,234 $ (456) $ 2,778

Goodwill(1) .............................. 62,420 40,545 102,965

Intangible assets(2) ......................... 12,800 21,642 34,442

Deferred tax liability ........................ (4,369) (4,984) (9,353)

Total purchase price consideration(3) .......... $74,085 $56,747 $130,832

(1) The goodwill represents the excess value over both tangible and intangible assets acquired.

The goodwill in these transactions is primarily attributable to expected operational synergies,

the assembled workforces, and the future development initiatives of the assembled

workforces. None of the goodwill is expected to be deductible for tax purposes.

(2) Identifiable definite-lived intangible assets were comprised of developed technology of

$24.3 million, trade name of $4.3 million, patents of $3.4 million, customer relationships of

$1.2 million, registered userbase of $0.8 million and non-compete agreements of

$0.4 million. The overall weighted-average life of the identifiable definite-lived intangible

assets acquired in the purchase of the companies was 4.5 years, which will be amortized on a

straight-line basis over their estimated useful lives.

(3) Subject to adjustment based on (i) purchase price adjustment provisions, and

(ii) indemnification obligations of the acquired company stockholders.

The Company’s consolidated financial statements include the operating results of all acquired

businesses from the date of each acquisition. Pro forma results of operations for all of these acquisitions

have not been presented as the financial impact to the Company’s consolidated financial statements, both

individually and in aggregate, are not material.

82