LinkedIn 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

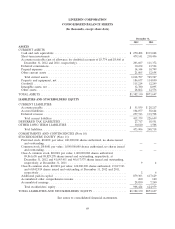

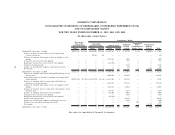

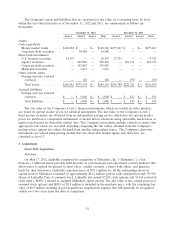

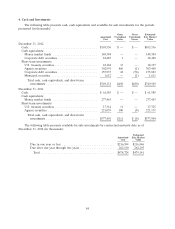

LINKEDIN CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

2012 2011 2010

OPERATING ACTIVITIES:

Net income .................................................... $ 21,610 $ 11,912 $ 15,385

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization ....................................... 79,849 43,100 19,551

Provision for doubtful accounts and sales returns ........................... 623 3,109 1,811

Stock-based compensation ......................................... 86,319 29,768 8,832

Excess income tax benefit from the exercise of stock options .................... (35,829) (1,600) (129)

Changes in operating assets and liabilities:

Accounts receivable ............................................ (91,277) (54,908) (35,677)

Deferred commissions ........................................... (17,145) (5,271) (5,798)

Prepaid expenses and other assets ................................... (7,663) (14,111) (4,259)

Accounts payable and other liabilities ................................. 85,561 36,950 15,595

Income taxes, net .............................................. 27,077 9,662 (493)

Deferred revenue .............................................. 117,945 74,813 39,535

Net cash provided by operating activities ............................. 267,070 133,424 54,353

INVESTING ACTIVITIES:

Purchases of property and equipment .................................... (125,420) (88,978) (50,026)

Purchases of investments ............................................ (443,992) (251,174) —

Sales of investments ............................................... 58,594 8,255 —

Maturities of investments ............................................ 139,911 3,500 —

Purchases of intangible assets and acquisitions, net of cash acquired ................ (57,036) (7,404) (4,467)

Changes in deposits and restricted cash ................................... (5,085) (2,681) (1,140)

Net cash used in investing activities ................................. (433,028) (338,482) (55,633)

FINANCING ACTIVITIES:

Proceeds from initial public offering, net of offering costs ....................... — 248,803 (397)

Proceeds from follow-on offering, net of offering costs ......................... (382) 177,700 —

Proceeds from issuance of common stock from employee stock options .............. 44,402 13,124 1,307

Proceeds from issuance of common stock from the employee stock purchase plan ........ 16,862 6,287 —

Proceeds from early exercise of employee stock options ........................ 48 4,995 3,438

Proceeds from exercise of warrant ...................................... — — 23

Excess income tax benefit from the exercise of stock options ..................... 35,829 1,600 129

Repurchase of common stock ......................................... (196) (44) (175)

Net cash provided by financing activities .............................. 96,563 452,465 4,325

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS .... 755 (1,310) (73)

CHANGE IN CASH AND CASH EQUIVALENTS ............................ (68,640) 246,097 2,972

CASH AND CASH EQUIVALENTS—Beginning of period ....................... 339,048 92,951 89,979

CASH AND CASH EQUIVALENTS—End of period ........................... $270,408 $ 339,048 $ 92,951

SUPPLEMENTAL DISCLOSURES OF OTHER CASH FLOW INFORMATION:

Cash paid for income taxes .......................................... $ 2,828 $ 2,261 $ 4,006

SUPPLEMENTAL DISCLOSURES OF NONCASH INVESTING AND FINANCING

ACTIVITIES:

Conversion of preferred stock to common stock ............................. $ — $103,827 $ —

Purchases of property and equipment recorded in accounts payable and accrued liabilities . . $ 22,223 $ 10,974 $ 2,231

Deferred offering costs not yet paid ..................................... $ — $ 382 $ 1,318

Vesting of early exercised stock options ................................... $ 3,365 $ 3,704 $ 767

Issuance of Class A common stock for business combinations ..................... $ 71,478 $ 8,059 $ —

See notes to consolidated financial statements.

74