LinkedIn 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

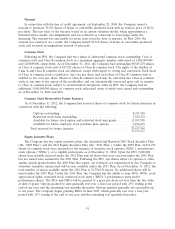

Warrant

In connection with the line of credit agreement, on September 20, 2004, the Company issued a

warrant to purchase 70,365 shares of Series A convertible preferred stock with an exercise price of $0.32

per share. The fair value of the warrant, based on an option valuation model, which approximates a

binomial lattice model, was insignificant and was reflected as a discount to borrowings under the

financing. The warrant was exercisable for seven years from the date of issuance. In May 2010, the

warrant was exercised. As a result, the Company issued 70,365 shares of Series A convertible preferred

stock and received an insignificant amount of proceeds.

Common Stock

Following its IPO, the Company had two classes of authorized common stock outstanding; Class A

common stock and Class B common stock at a maximum aggregate number authorized of 1,000,000,000

and 120,000,000, respectively. As of December 31, 2012, the Company had outstanding 88,829,278 shares

of Class A common stock and 19,817,923 shares of Class B common stock. The rights of the holders of

Class A and Class B common stock are identical, except with respect to voting and conversion. Each share

of Class A common stock is entitled to one vote per share and each share of Class B common stock is

entitled to ten votes per share. Shares of Class B common stock may be converted into Class A common

stock at any time at the option of the stockholder, and are automatically converted upon sale or transfer

to Class A common stock, subject to certain limited exceptions. After its IPO, the Company had an

additional 1,000,000,000 shares of common stock authorized, none of which were issued and outstanding

as of December 31, 2012 and 2011.

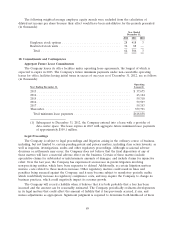

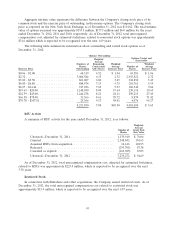

Common Stock Reserved for Future Issuance

As of December 31, 2012, the Company had reserved shares of common stock for future issuances in

connection with the following:

Options outstanding ....................................... 8,251,850

Restricted stock units outstanding ............................. 3,239,272

Available for future stock option and restricted stock unit grants ...... 11,039,588

Available for future employee stock purchase plan options ........... 3,102,639

Total reserved for future issuance ............................... 25,633,349

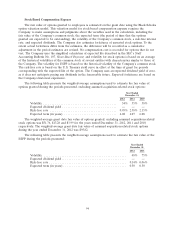

Equity Incentive Plans

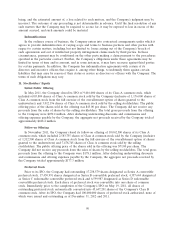

The Company has two equity incentive plans: the Amended and Restated 2003 Stock Incentive Plan

(the ‘‘2003 Plan’’) and the 2011 Equity Incentive Plan (the ‘‘2011 Plan’’). Under the 2003 Plan, 34,814,756

shares of common stock were reserved for the issuance of incentive stock options (‘‘ISOs’’), nonstatutory

stock options (‘‘NSOs’’), or to eligible participants as of December 31, 2012. Upon the IPO, 2,000,000

shares were initially reserved under the 2011 Plan and all shares that were reserved under the 2003 Plan

but not issued were assumed by the 2011 Plan. Following the IPO, any shares subject to options or other

similar awards granted under the 2003 Plan that expire, are forfeited, are repurchased by the Company or

otherwise terminate unexercised will become available under the 2011 Plan. As of December 31, 2012, the

total number of shares available under the 2011 Plan is 22,754,032 shares. No additional shares will be

issued under the 2003 Plan. Under the 2011 Plan, the Company has the ability to issue ISOs, NSOs, stock

appreciation rights, restricted stock, restricted stock units (‘‘RSUs’’), performance units and/or

performance shares. The ISOs and NSOs will be granted at a price per share not less than the fair value

at date of grant. Options granted to date generally vest over a four-year period with 25% vesting at the

end of one year and the remaining vest monthly thereafter. Options granted generally are exercisable up

to ten years. The Company began granting RSUs in June 2011, which generally vest over a four-year

period with 25% vesting at the end of one year and the remaining vest quarterly thereafter.

91