LinkedIn 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

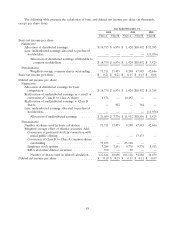

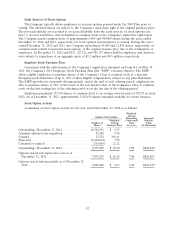

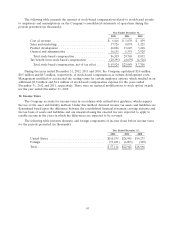

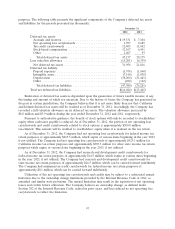

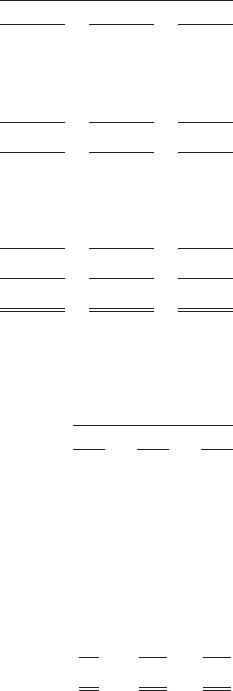

The following table presents the components of the provision for income taxes for the periods

presented (in thousands):

Year Ended December 31,

2012 2011 2010

Current:

Federal .................................... $30,919 $ 11 $ 107

State ...................................... 3,452 204 541

Foreign .................................... 4,390 1,307 224

Total current .................................. 38,761 1,522 872

Deferred:

Federal .................................... (395) 8,258 2,847

State ...................................... (2,629) 726 (247)

Foreign .................................... (233) 524 109

Total deferred ................................. (3,257) 9,508 2,709

Total provision ................................ $35,504 $11,030 $3,581

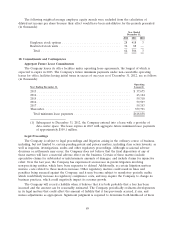

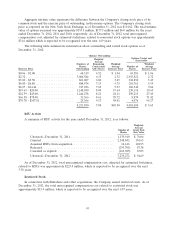

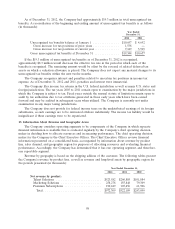

The following table presents a reconciliation of the statutory federal rate and the Company’s effective

tax rate for the periods presented:

Year Ended

December 31,

2012 2011 2010

U.S. federal taxes at statutory rate ........................ 35% 35% 35%

State income taxes, net of federal benefit ................... 2 (12) 1

Foreign rate differential ................................ 12 11 (1)

Permanent differences ................................. 1 4 1

Stock-based compensation .............................. 3 11 10

Change in valuation allowance ........................... (2) 17 (20)

Research and development credits ........................ — (21) (8)

Transaction-related expenses ............................ 11 1 —

Other ............................................. — 2 1

Total .............................................. 62% 48% 19%

On January 2, 2013, the President signed into law The American Taxpayer Relief Act of 2012 (the

‘‘2012 Act’’). Under prior law, a taxpayer was entitled to a research tax credit for qualifying amounts paid

or incurred on or before December 31, 2011. The 2012 Act extends the research credit for two years to

December 31, 2013. The extension of the research credit is retroactive and includes amounts paid or

incurred after December 31, 2011. As a result of the retroactive extension, we expect to recognize a tax

benefit of approximately $11.0 million to $12.5 million for qualifying amounts incurred in 2012. The tax

benefit will be recognized in the period of enactment, which is the first quarter of 2013.

Deferred income taxes reflect the net tax effects of temporary differences between the carrying

amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax

96