LinkedIn 2012 Annual Report Download - page 68

Download and view the complete annual report

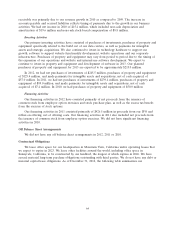

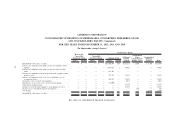

Please find page 68 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We enter into foreign currency forward contracts to hedge against assets and liabilities for which we

have foreign currency exposure to minimize the risk that our earnings will be adversely affected by

exchange rate fluctuations. Our foreign currency forward contracts are not designated as hedging

instruments. These derivative instruments are carried at fair value with changes in the fair value recorded

to other income (expense), net in our consolidated statements of operations. These contracts do not

subject us to material balance sheet risk due to exchange rate movements because gains and losses on

these derivatives are intended to offset gains and losses on the hedged foreign currency denominated

assets and liabilities.

As of December 31, 2012, we had outstanding foreign currency forward contracts with a total

notional amount of $83.5 million. If overall foreign currency exchange rates appreciated (depreciated)

uniformly by 5% against the U.S. Dollar, our foreign currency forward contracts outstanding as of

December 31, 2012 would experience a loss (gain) of approximately $3.9 million.

Inflation Risk

We do not believe that inflation has had a material effect on our business, financial condition or

results of operations. If our costs were to become subject to significant inflationary pressures, we may not

be able to fully offset such higher costs through price increases. Our inability or failure to do so could

harm our business, financial condition and results of operations.

66