LinkedIn 2012 Annual Report Download - page 80

Download and view the complete annual report

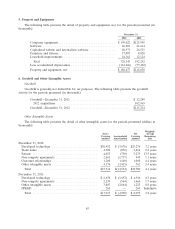

Please find page 80 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Intangible assets. Intangible assets consist of identifiable intangible assets, primarily developed

technology, resulting from the Company’s acquisitions. Acquired intangible assets are recorded at fair

value, net of accumulated amortization. Intangible assets are amortized on a straight-line basis over their

estimated useful lives.

Long-lived assets. The Company evaluates its long-lived assets for impairment, including property

and equipment and intangible assets, whenever events or changes in circumstances indicate that the

carrying amount of such assets may not be recoverable. Recoverability of assets to be held and used is

measured by a comparison of the carrying amount of an asset to future undiscounted net cash flows

expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be

recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value

of the assets.

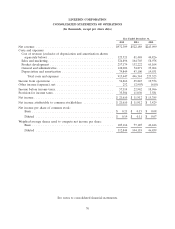

Revenue Recognition

In general, the Company recognizes revenue when (i) persuasive evidence of an arrangement exists,

(ii) delivery has occurred or services have been rendered to the customer, (iii) the fee is fixed or

determinable, and (iv) collectability is reasonably assured. Where arrangements have multiple elements,

revenue is allocated to the elements based on the relative selling price method and revenue is recognized

based on the Company’s policy for each respective element.

The Company generates revenue primarily from sales of the following services:

•Talent Solutions—Talent Solutions revenue is derived primarily from providing access to the

LinkedIn Recruiter product and job postings. The Company provides access to its professional

database of both active and passive job candidates with LinkedIn Recruiter, which allows corporate

recruiting teams to identify candidates based on industry, job function, geography, experience/

education, and other specifications. Revenue from providing access to the LinkedIn Recruiter

product is recognized ratably over the subscription period, which consists primarily of annual

subscriptions that are billed monthly, quarterly, or annually. The Company also earns revenue from

the placement of job postings on its website, which generally run for 30 days. Independent

recruiters can pay to post job openings that are accessible through job searches or targeted job

matches. Revenue from job postings is recognized as the posting is displayed or the contract

period, whichever is shorter.

•Marketing Solutions—The Company earns revenue from the display of advertisements (both graphic

and text link) on its website primarily based on a cost per advertisement model. Revenue from

internet advertising is recognized net of any related agency commissions as the online

advertisements are displayed on the Company’s website on a gross revenue basis for those

transactions where the Company pays a commission on the sale or otherwise as net value received.

The typical duration of the Company’s advertising contracts is approximately two months.

•Premium Subscriptions—The Company sells various subscriptions to customers that allow users to

have further access to premium services via its LinkedIn.com website. The Company offers its

members monthly or annual subscriptions. Revenue from Premium Subscription services is

recognized ratably over the contractual period, generally from one to 12 months.

Amounts billed or collected in excess of revenue recognized are included as deferred revenue. Sales

tax is excluded from reported net revenue. Although historical refunds have been minimal, the Company

estimates allowances, for each revenue type shown above, based on information available as of each

balance sheet date. This information includes historical refunds as well as specific known service quality

issues. The Company records revenue for transactions in which it acts as an agent on a net basis, and

revenue for transactions in which it acts as a principal on a gross basis.

A majority of the Company’s arrangements for Talent Solutions and Marketing Solutions include

multiple deliverables. In accordance with authoritative guidance on revenue recognition, the Company

allocates consideration at the inception of an arrangement to all deliverables based on the relative selling

78