LinkedIn 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

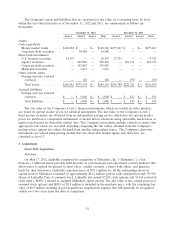

72

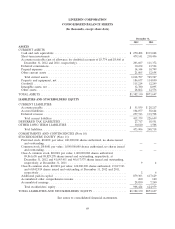

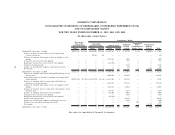

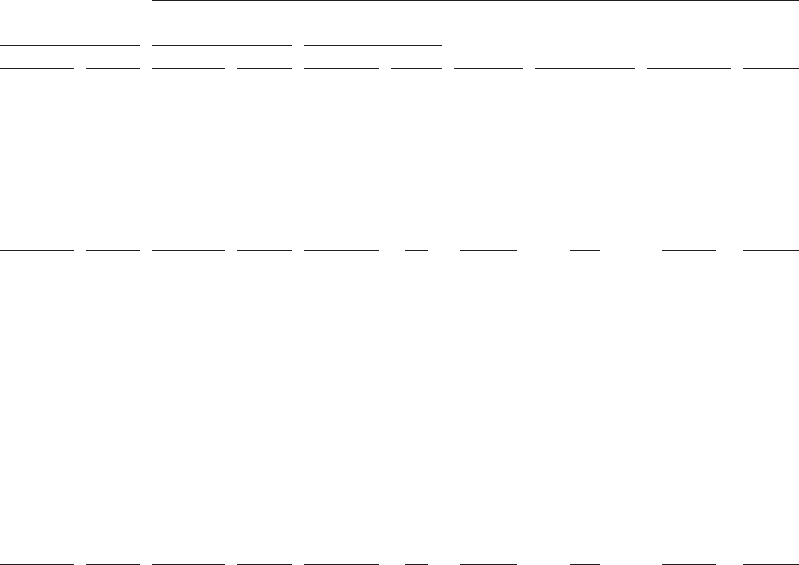

LINKEDIN CORPORATION

CONSOLIDATED STATEMENTS OF REDEEMABLE CONVERTIBLE PREFERRED STOCK

AND STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2012, 2011 AND 2010

(In thousands, except shares)

Stockholders’ Equity

Redeemable Accumulated

Convertible Convertible Additional Other Accumulated

Preferred Stock Preferred Stock Common Stock Paid-In Comprehensive Earnings

Shares Amount Shares Amount Shares Amount Capital Income (Loss) (Deficit) Total

BALANCE—December 31, 2009 ................... 10,957,631 $ 87,981 34,619,205 $ 15,413 41,745,728 $ 4 $ 13,725 $ (3) $(20,057) $ 9,082

Issuance of Series A convertible preferred stock upon

exercise of warrant ........................ — — 70,365 433 — — — — — 433

Issuance of common stock upon exercise of employee stock

options ................................ — — — — 1,796,826 — 1,307 — — 1,307

Vesting of early exercised stock options ............. — — — — — — 767 — — 767

Repurchase of unvested early exercised stock options ..... — — — — (233,812) — — — — —

Stock-based compensation ..................... — — — — — — 9,146 — — 9,146

Income tax benefit from employee stock option exercises . . . — — — — — — 129 — — 129

Net income .............................. — — — — — — — — 15,385 15,385

BALANCE—December 31, 2010 ................... 10,957,631 $ 87,981 34,689,570 $ 15,846 43,308,742 $ 4 $ 25,074 $ (3) $ (4,672) $ 36,249

Issuance of common stock upon initial public offering, net of

offering costs ............................ — — — — 6,003,804 1 248,405 — — 248,406

Conversion of preferred stock to common stock upon initial

public offering ........................... (10,957,631) (87,981) (34,689,570) (15,846) 45,647,201 5 103,822 — — 87,981

Issuance of common stock in connection with follow-on

offering, net of offering costs .................. — — — — 2,583,755 — 177,318 — — 177,318

Issuance of common stock upon exercise of employee stock

options ................................ — — — — 3,665,152 — 13,068 — — 13,068

Issuance of common stock in connection with employee stock

purchase plan ............................ — — — — 164,367 — 6,287 — — 6,287

Issuance of common stock related to acquisitions ....... — — — — 129,203 — 8,059 — — 8,059

Vesting of early exercised stock options ............. — — — — — — 3,704 — — 3,704

Repurchase of unvested early exercised stock options ..... — — — — (21,830) — — — — —

Stock-based compensation ..................... — — — — — — 30,292 — — 30,292

Income tax benefit from employee stock option exercises . . . — — — — — — 1,600 — — 1,600

Change in net unrealized gain on investments .......... — — — — — — — 103 — 103

Net income .............................. — — — — — — — — 11,912 11,912

BALANCE—December 31, 2011 ................... — $ — — $ — 101,480,394 $10 $617,629 $100 $ 7,240 $624,979

See notes to consolidated financial statements.