Lexmark 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

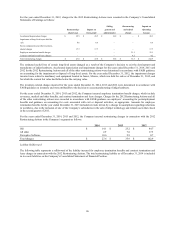

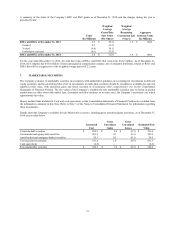

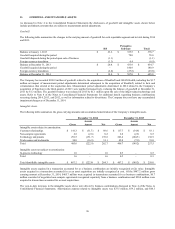

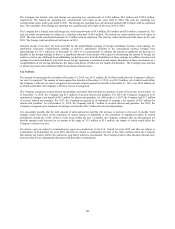

December 31, 2014

Less than 12 Months 12 Months or More Total

Fair Unrealized Fair Unrealized Fair Unrealized

Value Loss Value Loss Value Loss

Corporate debt securities $ 154.9 $ (0.5) $ – $ – $ 154.9 $ (0.5)

Asset-backed and mortgage-backed securities 44.2 (0.1) 0.7 – 44.9 (0.1)

Government and agency debt securities 184.6 (0.3) – – 184.6 (0.3)

Total $ 383.7 $ (0.9) $ 0.7 $ – $ 384.4 $ (0.9)

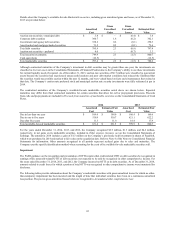

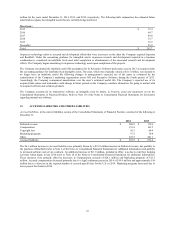

December 31, 2013

Less than 12 Months 12 Months or More Total

Fair Unrealized Fair Unrealized Fair Unrealized

Value Loss Value Loss Value Loss

Auction rate securities $ – $ – $ 6.7 $ (1.1) $ 6.7 $ (1.1)

Corporate debt securities 85.7 (0.2) 1.2 – 86.9 (0.2)

Asset-backed and mortgage-backed securities 43.4 (0.1) 0.1 – 43.5 (0.1)

Government and agency debt securities 158.5 (0.1) – – 158.5 (0.1)

Total $ 287.6 $ (0.4) $ 8.0 $ (1.1) $ 295.6 $ (1.5)

As of December 31, 2014 and 2013, none of the Company’s marketable securities for which OTTI has been incurred were in an

unrealized loss position.

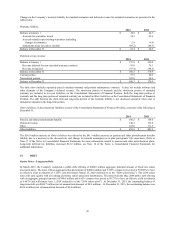

Corporate Debt Securities

Unrealized losses on the Company’s corporate debt securities are attributable to current economic conditions and are not due to credit

quality. Because the Company does not intend to sell and will not be required to sell the securities before recovery of their net book

values, which may be at maturity, the Company does not consider securities in its corporate debt portfolio to be other-than-temporarily

impaired at December 31, 2014.

Asset-Backed and Mortgage-Backed Securities

Credit losses for the asset-backed and mortgage-backed securities are derived by examining the significant drivers that affect loan

performance such as pre-payment speeds, default rates, and current loan status. These drivers are used to apply specific assumptions to

each security and are further divided in order to separate the underlying collateral into distinct groups based on loan performance

characteristics. For instance, more weight is placed on higher risk categories such as collateral that exhibits higher than normal default

rates, those loans originated in high risk states where home appreciation has suffered the most severe correction, and those loans

which exhibit longer delinquency rates. Based on these characteristics, collateral-specific assumptions are applied to build a model to

project future cash flows expected to be collected. These cash flows are then discounted at the current yield used to accrete the

beneficial interest, which approximates the effective interest rate implicit in the bond at the date of acquisition for those securities

purchased at par. The unrealized losses on the Company’s remaining asset-backed and mortgage-backed securities are due to

constraints in market liquidity for certain portions of these sectors in which the Company has investments, and are not due to credit

quality. Because the Company does not intend to sell and will not be required to sell the securities before recovery of their net book

values, the Company does not consider the remainder of its asset-backed and mortgage-backed debt portfolio to be other-than-

temporarily impaired at December 31, 2014.

Government and Agency Securities

The unrealized losses on the Company’s investments in government and agency securities are the result of interest rate effects.

Because the Company does not intend to sell the securities and it is not more likely than not that the Company will be required to sell

the securities before recovery of their net book values, the Company does not consider these investments to be other-than-temporarily

impaired at December 31, 2014.

93