Lexmark 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

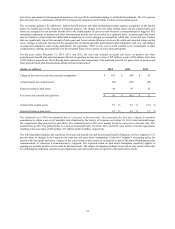

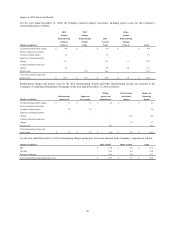

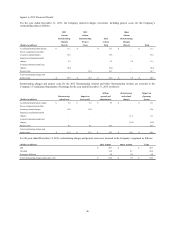

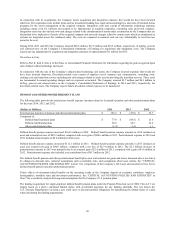

Revenue by Reportable Segment

(Dollars in millions) 2014 2013 % Change 2013 2012 % Change

ISS $ 3,414.8 $ 3,444.0 (1) % $ 3,444.0 $ 3,641.6 (5) %

Perceptive Software 295.7 223.6 32 % 223.6 156.0 43 %

Total revenue $ 3,710.5 $ 3,667.6 1 % $ 3,667.6 $ 3,797.6 (3) %

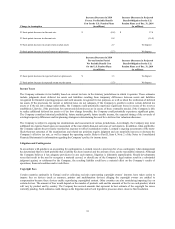

Revenue by Product

(Dollars in millions) 2014 2013 % Change 2013 2012 % Change

Hardware (1) $ 782.1 $ 762.8 3 % $ 762.8 $ 826.5 (8) %

Supplies (2) 2,445.9 2,484.4 (2) % 2,484.4 2,640.1 (6) %

Software and Other (3) 482.5 420.4 15 % 420.4 331.0 27 %

Total revenue $ 3,710.5 $ 3,667.6 1 % $ 3,667.6 $ 3,797.6 (3) %

(1) Includes laser, inkjet, and dot matrix hardware and the associated features sold on a unit basis or through a managed service agreement

(2) Includes laser, inkjet, and dot matrix supplies and associated supplies services sold on a unit basis or through a managed service agreement

(3) Includes parts and service related to hardware maintenance and includes software licenses and the associated software maintenance services sold

on a unit basis or as a subscription service

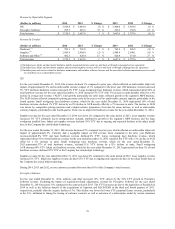

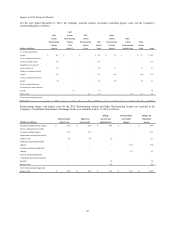

ISS

For the year ended December 31, 2014, ISS revenue declined 1% compared to prior year, which reflected an unfavorable inkjet exit

impact of approximately 4% and an unfavorable currency impact of 1% compared to the prior year. ISS hardware revenue increased

2% YTY and laser hardware revenue increased 2% YTY. Large workgroup laser hardware revenue, which represented about 84% of

total hardware revenue for the year ended December 31, 2014 increased 3% YTY with 7% increase in units partially offset by a 4%

decline in average unit revenue (“AUR”). Unit growth, particularly for color units, reflected growth in the segment’s MPS business.

The AUR decline reflected competitive pricing pressures early in the year as well as unfavorable currency impacts, particularly in the

fourth quarter. Small workgroup laser hardware revenue, which for the year ended December 31, 2014 represented 16% of total

hardware revenue, declined 1% YTY driven by an 8% decline in AUR mostly offset by a 7% increase in units. The decline in AUR

was driven by competitive pricing pressures and a higher relative proportion of revenue for mono devices, as well as unfavorable

currency impacts, particularly in the fourth quarter. There was no inkjet exit hardware revenue for the year ended December 31, 2014.

Supplies revenue for the year ended December 31, 2014 was down 2% compared to the same period in 2013. Laser supplies revenue

increased 5% YTY primarily due to strong end-user demand, attributed to growth in the segment’s MPS business and the large

workgroup installed base. Inkjet exit supplies revenue declined 36% YTY due to ongoing and expected declines in the inkjet install

base as the Company has exited inkjet technology.

For the year ended December 31, 2013, ISS revenue decreased 5% compared to prior year, which reflected an unfavorable inkjet exit

impact of approximately 6%. Currency had a negligible impact on ISS revenue when compared to the prior year. Hardware

revenue declined 8% YTY and laser hardware revenue declined 2% YTY. Large workgroup laser hardware revenue, which

represented about 83% of total hardware revenue for the year ended December 31, 2013 remained flat YTY with a 3% decline in AUR

offset by a 3% increase in units. Small workgroup laser hardware revenue, which for the year ended December 31,

2013 represented 17% of total hardware revenue, declined 11% YTY driven by a 15% decline in units. Small workgroup

AUR increased 4% YTY. Inkjet exit hardware revenue, which for the year ended December 31, 2013 represented less than 1% of total

hardware revenue, declined 92% YTY as the Company has exited inkjet technology.

Supplies revenue for the year ended December 31, 2013 was down 6% compared to the same period in 2012. Laser supplies revenue

increased 2% YTY. Inkjet exit supplies revenue declined 32% YTY due to ongoing and expected declines in the inkjet install base as

the Company has exited inkjet technology.

During 2014, 2013 and 2012, no one customer accounted for more than 10% of the Company’s total revenues.

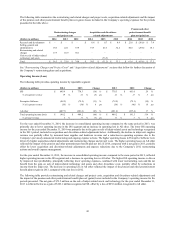

Perceptive Software

For the year ended December 31, 2014, software and other increased 15% YTY, driven by the 32% YTY growth in Perceptive

Software revenue. Excluding the impact of acquisition-related adjustments, revenue for Perceptive Software for the year ended

December 31, 2014 increased 31% compared to the same period in 2013. The YTY increases are due to the acquisition of ReadSoft in

2014 as well as the full-year benefit of the acquisitions of Saperion and PACSGEAR in the third and fourth quarters of 2013,

respectively, partially offset by organic decline of 3%. This decline was driven by lower YTY perpetual license revenue, particularly

in the U.S., attributed to timing for closing of customer contracts as well as selection of a subscription model by certain customers

39