Lexmark 2014 Annual Report Download - page 136

Download and view the complete annual report

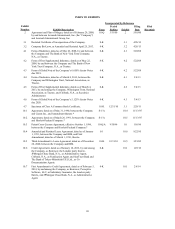

Please find page 136 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10.8 Second Amended and Restated Receivables Purchase

Agreement, dated as of October 10, 2013, by and among

Lexmark Receivables Corporation, as Seller; Gotham Funding

Corporation, as an Investor; Fifth Third Bank, as an Investor

Agent and a Bank; The Bank of Tokyo-Mitsubishi UFJ, Ltd.,

New York Branch, as Program Agent, an Investor Agent and a

Bank; the Company, as Collection Agent and Originator; and

Perceptive Software, LLC, as an Originator.

10-Q 9/30/13 10.1 11/7/13

10.9 Amended and Restated Purchase and Contribution Agreement,

dated as of October 10, 2013, by and between the Company

and Perceptive Software, LLC, as Sellers; and Lexmark

Receivables Corporation, as Purchaser.

10-Q 9/30/13 10.2 11/7/13

10.10 Omnibus Amendment No. 1 to Second Amended and Restated

Receivables Purchase Agreement and Amended and Restated

Purchase and Contribution Agreement, dated as of October 9,

2014.

8-K 10.1 10/15/14

10.11 Master Inkjet Sale Agreement by and among the Company,

Lexmark International Technology, S.A., and Funai Electric

Company, Ltd., dated April 1, 2013.

10-Q 3/31/13 10.1 5/9/13

10.12 Company Stock Incentive Plan, as Amended and Restated,

effective April 23, 2009.+

DEF14A A 3/6/09

10.13 Form of Non-Qualified Stock Option Agreement pursuant to

the Company’s Stock Incentive Plan.+

10-Q 9/30/10 10.2 11/3/10

10.14 Form of Performance-Based Non-Qualified Stock Option

Agreement pursuant to the Company’s Stock Incentive Plan.+

10-Q 6/30/09 10.1 8/3/09

10.15 Form of Time-Based Restricted Stock Unit Award Agreement

pursuant to the Company’s Stock Incentive Plan for Awards

made prior to 2013.+

10-K 12/31/08 10.24 2/27/09

10.16 Form of Time-Based Restricted Stock Unit Award Agreement

pursuant to the Company’s Stock Incentive Plan for Awards

made in 2013.+

8-K 10.1 2/26/13

10.17 Form of 2012-2014 Performance-Based Restricted Stock Unit

Award Agreement pursuant to the Company’s Stock Incentive

Plan.+

8-K 10.1 2/28/12

10.18 Form of 2013 Performance-Based Restricted Stock Unit Award

Agreement pursuant to the Company’s Stock Incentive Plan.+

8-K 10.3 3/14/13

10.19 Form of 2013-2015 Performance-Based Restricted Stock Unit

Award Agreement pursuant to the Company’s Stock Incentive

Plan.+

8-K 10.2 3/14/13

10.20 Form of 2012-2014 Long-Term Incentive Plan Award

Agreement pursuant to the Company’s Stock Incentive Plan.+

8-K 10.2 2/28/12

10.21 Form of 2013-2015 Long-Term Incentive Plan Award

Agreement pursuant to the Company’s Stock Incentive Plan.+

8-K 10.1 3/14/13

10.22 Company 2013 Equity Compensation Plan, effective April 25,

2013.+

8-K 10.1 4/26/13

132