Lexmark 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

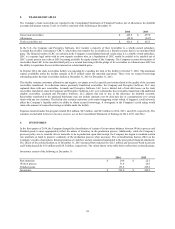

The ASR Agreements discussed in the preceding paragraph were accounted for as initial treasury stock transactions and forward stock

purchase contracts. The initial repurchase of shares resulted in a reduction of the outstanding shares used to calculate the weighted-

average common shares outstanding for basic and diluted net income per share on the effective date of the agreements. The forward

stock purchase contract (settlement provision) was considered indexed to the Company's own stock and was classified as an equity

instrument under accounting guidance applicable to contracts in an entity's own equity.

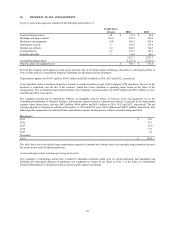

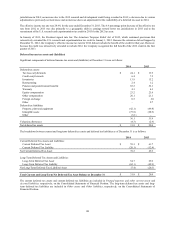

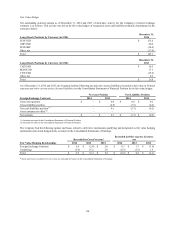

Dividends

The Company’s dividend activity during the year ended December 31, 2014 was as follows:

Lexmark International, Inc.

Class A Common Stock

Declaration Date Record Date Payment Date

Dividend Per

Share Cash Outlay

February 20, 2014 March 03, 2014 March 14, 2014 $ 0.30 $ 18.6

April 24, 2014 May 30, 2014 June 13, 2014 0.36 22.4

July 24, 2014 August 29, 2014 September 12, 2014 0.36 22.2

October 23, 2014 November 28, 2014 December 12, 2014 0.36 22.1

Total Dividends $ 1.38 $ 85.3

The payment of the cash dividends also resulted in the issuance of additional dividend equivalent units to holders of restricted stock

units. Diluted weighted-average Lexmark Class A share amounts presented reflect this issuance. All cash dividends and dividend

equivalent units are accounted for as reductions of Retained earnings.

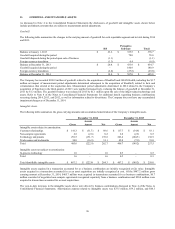

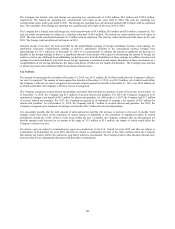

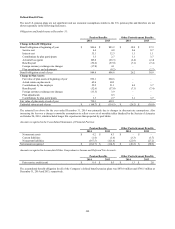

Accumulated Other Comprehensive Earnings (Loss)

The following tables provide the tax benefit or expense attributed to each component of Other comprehensive (loss) earnings:

Year Ended December 31, 2014

Change, Tax benefit Change,

net of tax (liability) pre-tax

Components of other comprehensive (loss) earnings:

Foreign currency translation adjustment $ (71.2) $ 4.7 $ (75.9)

Recognition of pension and other postretirement benefit plans prior service

credit, net of (amortization) (0.2) (0.1) (0.1)

Net unrealized (loss) gain on OTTI marketable securities (0.1) – (0.1)

Net unrealized (loss) gain on marketable securities (0.8) (0.2) (0.6)

Unrealized gain on cash flow hedges 15.9 (1.7) 17.6

Total other comprehensive (loss) earnings $ (56.4) $ 2.7 $ (59.1)

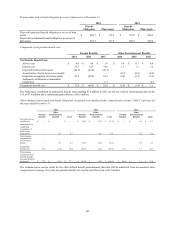

Year Ended December 31, 2013

Change, Tax benefit Change,

net of tax (liability) pre-tax

Components of other comprehensive (loss) earnings:

Foreign currency translation adjustment $ (32.0) $ 3.5 $ (35.5)

Recognition of pension and other postretirement benefit plans prior service

credit 2.1 (0.8) 2.9

Net unrealized (loss) gain on marketable securities (1.1) – (1.1)

Forward starting interest rate swap designated as a cash flow hedge 0.9 (0.5) 1.4

Total other comprehensive (loss) earnings $ (30.1) $ 2.2 $ (32.3)

104