Lexmark 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

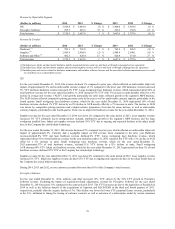

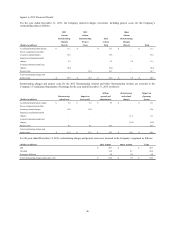

For the year ended December 31, 2012, restructuring charges and project costs were incurred in the Company’s segments as follows:

(Dollars in millions) 2012 Actions Other Actions Total

ISS $ 91.8 $ 0.8 $ 92.6

All other 26.6 1.9 28.5

Perceptive Software 0.7 – 0.7

Total restructuring charges and project costs $ 119.1 $ 2.7 $ 121.8

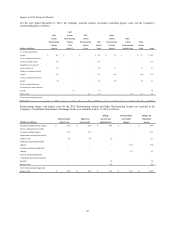

ACQUISITION AND DIVESTITURE-RELATED ADJUSTMENTS

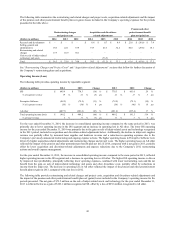

Pre-tax acquisition and divestiture-related adjustments affected the Company’s financial results as follows:

(Dollars in Millions) 2014 2013 2012

Reduction in revenue $ 17.1 $ 15.9 $ 5.5

Amortization of intangible assets 73.4 56.9 41.4

Acquisition and integration costs 28.6 17.6 18.9

Total acquisition-related adjustments $ 119.1 $ 90.4 $ 65.8

Gain on sale of inkjet-related technology and assets – (73.5) –

Divestiture costs 1.7 4.3 –

Total divestiture-related adjustments 1.7 (69.2) –

Total acquisition and divestiture-related adjustments $ 120.8 $ 21.2 $ 65.8

Reductions in revenue and amortization of intangible assets were recognized primarily in the Perceptive Software reportable segment.

Acquisition and integration costs were recognized primarily in All other. The net Gain on sale of inkjet-related technology and assets

of $73.5 million was composed of a gain of $103.1 million recognized in the ISS reportable segment offset by a loss of $29.6 million

recognized in All other. Divestiture costs were recognized primarily in ISS.

Acquisitions

In connection with acquisitions, Lexmark incurs costs and adjustments (referred to as “acquisition-related adjustments”) that affect the

Company’s financial results. These acquisition-related adjustments result from business combination accounting rules as well as

expenses that would otherwise have not been incurred by the Company if acquisitions had not taken place.

Reductions in revenue result from business combination accounting rules when deferred revenue balances assumed as part of

acquisitions are adjusted down to fair value. Fair value approximates the cost of fulfilling the service obligation, plus a reasonable

profit margin. Subsequent to acquisitions, the Company analyzes the amount of amortized revenue that would have been recognized

had the acquired company remained independent and had the deferred revenue balances not been adjusted to fair value. The $17.1

million, $15.9 million and $5.5 million downward adjustments to revenue for 2014, 2013 and 2012, respectively, are reflected in

Revenue presented on the Company’s Consolidated Statements of Earnings. The Company expects future pre-tax reductions in

revenue of approximately $13 million for 2015.

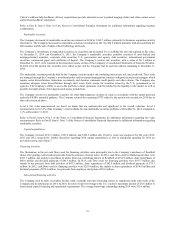

Due to business combination accounting rules, intangible assets are recognized as a result of acquisitions which were not previously

presented on the balance sheet of the acquired company. These intangible assets consist primarily of purchased technology, customer

relationships, trade names, in-process research and development and non-compete agreements. Subsequent to the acquisition date,

some of these intangible assets begin amortizing and represent an expense that would not have been recorded had the acquired

company remained independent. The Company incurred the following on the Consolidated Statements of Earnings for the

amortization of intangible assets.

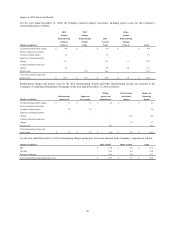

Amortization of intangible assets:

(Dollars in Millions) 2014 2013 2012

Recorded in Cost of product revenue $ 45.2 $ 36.5 $ 27.2

Recorded in Research and development 0.8 0.7 0.9

Recorded in Selling, general and administrative 27.4 19.7 13.3

Total amortization of intangible assets $ 73.4 $ 56.9 $ 41.4

For 2015, the Company expects pre-tax charges for the amortization of intangible assets to be approximately $71 million.

48