Lexmark 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

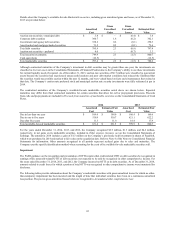

The 2020 senior notes pay interest on March 15 and September 15 of each year. The 2018 senior notes pay interest on June 1 and

December 1 of each year. The interest rate payable on the notes of each series is subject to adjustments from time to time if either

Moody’s Investors Service, Inc. or Standard and Poor’s Ratings Services downgrades the debt rating assigned to the notes to a level

below investment grade, or subsequently upgrades the ratings.

The senior notes contain typical restrictions on liens, sale leaseback transactions, mergers and sales of assets. There are no sinking

fund requirements on the senior notes and they may be redeemed at any time at the option of the Company, at a redemption price as

described in the related indenture agreements, as supplemented and amended, in whole or in part. If a “change of control triggering

event” as defined below occurs, the Company will be required to make an offer to repurchase the notes in cash from the holders at a

price equal to 101% of their aggregate principal amount plus accrued and unpaid interest to, but not including, the date of repurchase.

A “change of control triggering event” is defined as the occurrence of both a change of control and a downgrade in the debt rating

assigned to the notes to a level below investment grade.

In March 2013, the Company repaid its $350.0 million principal amount of 5.90% senior notes that were due on June 1, 2013 (referred

to as the “2013 senior notes”). For the year ended December 31, 2013, a loss of $3.3 million was recognized in the Consolidated

Statements of Earnings, related to $3.2 million of premium paid upon repayment and $0.1 million related to the write-off of related

debt issuance costs.

The Company used a portion of the net proceeds from the 2020 senior notes offering to extinguish the 2013 senior notes and used the

remaining net proceeds for general corporate purposes, including to fund share repurchases, fund dividends, finance acquisitions,

finance capital expenditures and operating expenses, and invest in subsidiaries.

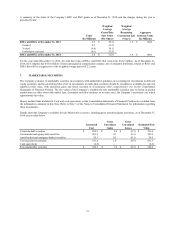

Credit Facility

Effective February 5, 2014, Lexmark amended its current $350 million 5-year senior, unsecured, multicurrency revolving credit

facility, entered into on January 18, 2012, by increasing its size to $500 million. In addition, the maturity date of the amended credit

facility was extended to February 5, 2019.

The facility provides for the availability of swingline loans and multicurrency letters of credit. Under certain circumstances and

subject to certain conditions, the aggregate amount available under the facility may be increased to a maximum of $650 million.

Interest on all borrowings under the facility is determined based upon either the Adjusted Base Rate or the Adjusted LIBO Rate, in

each case plus a margin that is adjusted on the basis of a combination of the Company’s consolidated leverage ratio and the

Company’s index debt rating.

The amended credit facility contains customary affirmative and negative covenants and also contains certain financial covenants,

including those relating to a minimum interest coverage ratio of not less than 3.0 to 1.0 and a maximum leverage ratio of not more

than 3.0 to 1.0 as defined in the agreement. The amended credit facility also limits, among other things, the Company’s indebtedness,

liens and fundamental changes to its structure and business. The Company was in compliance with all covenants and other

requirements set forth in the facility agreement at December 31, 2014.

At December 31, 2014 and December 31, 2013, there were no amounts outstanding under the revolving credit facility.

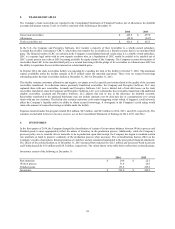

Other

Total cash paid for interest on the debt facilities amounted to $42.0 million, $39.1 million, and $42.3 million in 2014, 2013 and 2012,

respectively. The cash paid for interest amount of $39.1 million for 2013 does not include the premium paid upon repayment of the

Company’s 2013 senior notes of $3.2 million and the write-off of related debt issuance costs of $0.1 million.

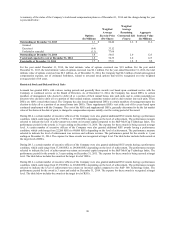

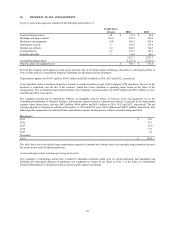

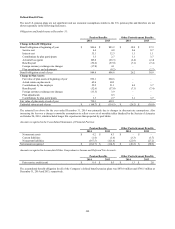

The components of Interest (income) expense, net in the Consolidated Statements of Earnings are as follows:

2014 2013 2012

Interest (income) $ (10.9) $ (11.0) $ (13.0)

Interest expense 42.5 44.0 42.6

Total $ 31.6 $ 33.0 $ 29.6

The Company had no capitalized interest costs in 2014 and 2013. The Company capitalized interest costs of $0.3 million in 2012.

99