Lexmark 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Subsequent to the date of the financial statements, the Company entered into and settled an ASR Agreement with a financial

institution counterparty, resulting in a total of approximately 0.7 million shares repurchased at a cost of $30 million. Upon delivery of

these shares, the number of shares held in treasury increased from approximately 35.7 million shares to approximately 36.4 million

shares. The payment of $30 million by the Company to the financial institution counterparty for the repurchase of shares was funded

from available U.S. cash equivalents and current marketable securities.

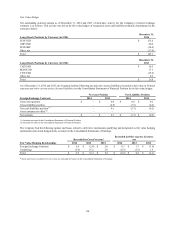

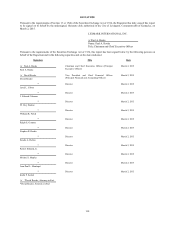

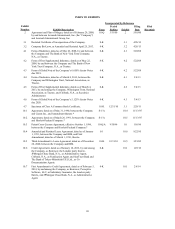

22. QUARTERLY FINANCIAL DATA (UNAUDITED)

First Second Third Fourth

Quarter Quarter Quarter Quarter

2014:

Revenue $ 877.7 $ 891.8 $ 918.1 $ 1,022.9

Gross profit (1) 341.6 351.2 357.3 359.7

Operating income (loss) (1) 53.9 62.4 54.5 (21.6)

Net earnings (loss) (1) 29.3 37.5 37.9 (25.6)

Basic EPS* (1) $ 0.47 $ 0.60 $ 0.61 $ (0.42)

Diluted EPS* (1) 0.46 0.59 0.60 (0.42)

Dividend declared per share 0.30 0.36 0.36 0.36

Stock prices:

High $ 46.29 $ 48.16 $ 51.17 $ 43.40

Low 34.40 41.52 42.43 37.99

2013:

Revenue $ 884.3 $ 886.7 $ 890.5 $ 1,006.1

Gross profit (2) 336.4 341.9 347.9 417.8

Operating income (2) 62.3 135.6 60.6 150.8

Net earnings (2) 40.0 94.1 33.7 94.0

Basic EPS* (2) $ 0.63 $ 1.49 $ 0.54 $ 1.51

Diluted EPS* (2) 0.62 1.47 0.53 1.48

Dividend declared per share 0.30 0.30 0.30 0.30

Stock prices:

High $ 28.32 $ 32.19 $ 41.11 $ 38.02

Low 21.79 25.45 31.79 33.31

The Company acquired AccessVia and Twistage in March of 2013, Saperion in September of 2013, PACSGEAR in October of 2013, ReadSoft in

August of 2014 and GNAX Health in October of 2014. The consolidated financial results include the results of these acquisitions subsequent to

the date of acquisition. Refer to Note 20 of the Notes to Consolidated Financial Statements for financial information regarding the Perceptive

Software segment, which includes the activities of all acquired businesses.

The sum of the quarterly data may not equal annual amounts due to rounding.

* The sum of the quarterly earnings (loss) per share amounts does not necessarily equal the annual earnings (loss) per share due to changes in

average share calculations. This is in accordance with prescribed reporting requirements.

(1) Net earnings for the first quarter of 2014 included $11.9 million of pre-tax restructuring charges and project costs in connection with the

Company’s restructuring plans and $22.0 million of pre-tax charges in connection with intangible amortization and integration costs associated

with the Company’s acquisitions.

Net earnings for the second quarter of 2014 included $11.8 million of pre-tax restructuring charges and project costs in connection with the

Company’s restructuring plans, $23.5 million of pre-tax charges in connection with intangible amortization and integration costs associated with

the Company’s acquisitions, and a pension and other postretirement benefit plan net gain of $2.9 million.

121