Lexmark 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11. GOODWILL AND INTANGIBLE ASSETS

As discussed in Note 4 to the Consolidated Financial Statements the disclosures of goodwill and intangible assets shown below

include preliminary amounts that are subject to measurement period adjustments.

Goodwill

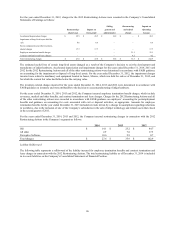

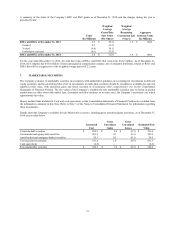

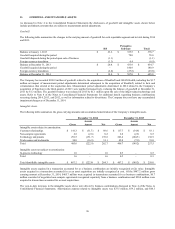

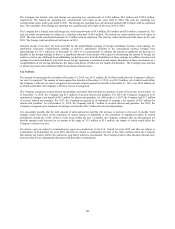

The following table summarizes the changes in the carrying amount of goodwill for each reportable segment and in total during 2014

and 2013.

ISS

Perceptive

Software Total

Balance at January 1, 2013 $ 23.2 $ 355.5 $ 378.7

Goodwill acquired during the period – 78.0 78.0

Goodwill disposed during the period upon sale of business (1.1) – (1.1)

Foreign currency translation (1.3) 0.4 (0.9)

Balance at December 31, 2013 $ 20.8 $ 433.9 $ 454.7

Goodwill acquired during the period – 180.9 180.9

Foreign currency translation (2.0) (27.8) (29.8)

Balance at December 31, 2014 $ 18.8 $ 587.0 $ 605.8

The Company has recorded $180.9 million of goodwill related to the acquisitions of ReadSoft and GNAX Health, including the $3.7

million net impact of measurement period adjustments determined subsequent to the acquisition of ReadSoft, related to facts and

circumstances that existed at the acquisition date. Measurement period adjustments determined in 2014 related to the Company’s

acquisition of Saperion in the third quarter of 2013 were applied retrospectively, reducing the balance of goodwill at December 31,

2013 by $1.3 million. The goodwill balance was reduced in 2013 by $1.1 million upon the sale of the inkjet-related technology and

assets. Refer to Note 4 of the Notes to Consolidated Financial Statements for additional details regarding business combinations

occurring during 2014, 2013, and 2012, as well as information related to divestitures. The Company does not have any accumulated

impairment charges as of December 31, 2014.

Intangible Assets

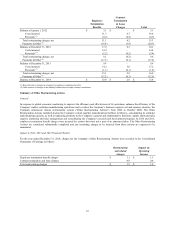

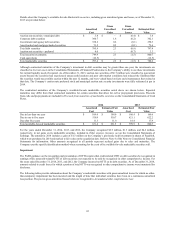

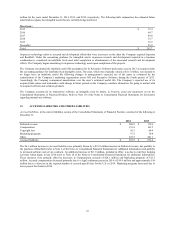

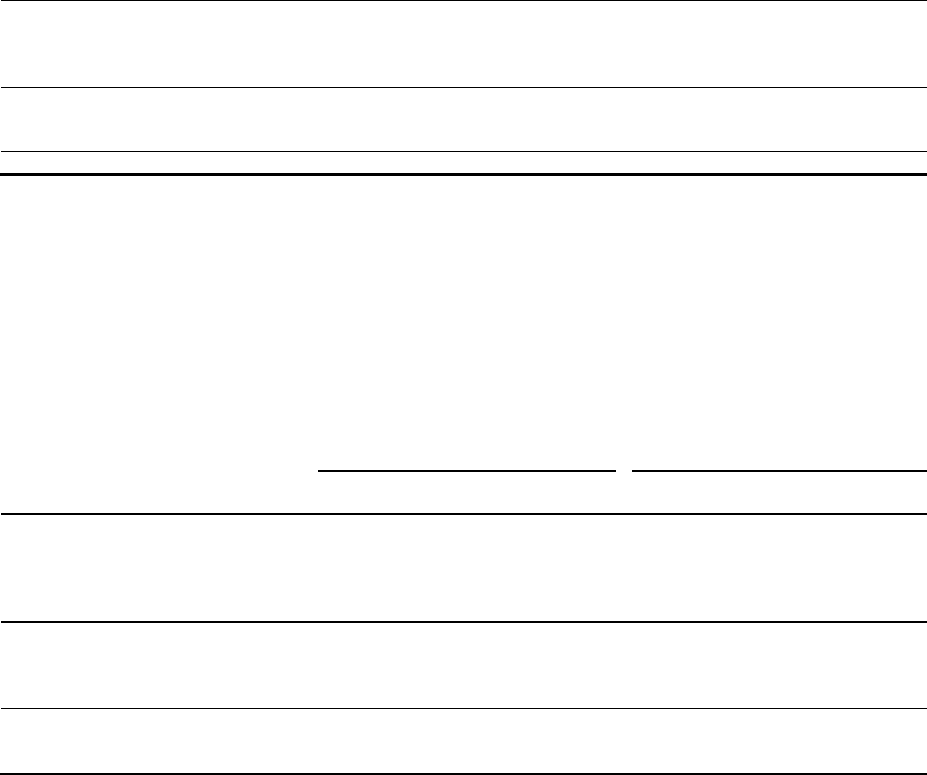

The following table summarizes the gross carrying amounts and accumulated amortization of the Company’s intangible assets.

December 31, 2014 December 31, 2013

Accum Accum

Gross Amort Net Gross Amort Net

Intangible assets subject to amortization:

Customer relationships $ 141.3 $ (51.7) $ 89.6 $ 117.7 $ (34.6) $ 83.1

Non-compete agreements 2.8 (2.6) 0.2 2.8 (2.3) 0.5

Technology and patents 291.5 (151.7) 139.8 243.4 (104.5) 138.9

Trade names and trademarks 50.0 (16.9) 33.1 42.8 (7.8) 35.0

Total 485.6 (222.9) 262.7 406.7 (149.2) 257.5

Intangible assets not subject to amortization:

In-process technology 1.6 – 1.6 0.5 – 0.5

Total 1.6 – 1.6 0.5 – 0.5

Total identifiable intangible assets $ 487.2 $ (222.9) $ 264.3 $ 407.2 $ (149.2) $ 258.0

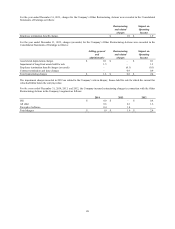

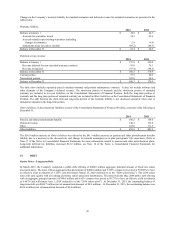

Intangible assets acquired in a transaction accounted for as a business combination are initially recognized at fair value. Intangible

assets acquired in a transaction accounted for as an asset acquisition are initially recognized at cost. Of the $487.2 million gross

carrying amount at December 31, 2014, $465.7 million were acquired in transactions accounted for as business combinations, $0.7

million consisted of negotiated non-compete agreements recognized separately from a business combination and $20.8 million were

acquired in transactions accounted for as asset acquisitions.

The year-to-date increases in the intangible assets above were driven by business combinations discussed in Note 4 of the Notes to

Consolidated Financial Statements. Amortization expense related to intangible assets was $75.5 million, $59.2 million, and $44.3

96