Lexmark 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

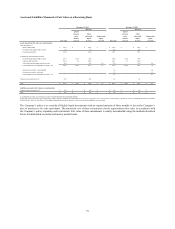

Corporate Debt Securities

The corporate debt securities in which the Company is invested most often have multiple sources of pricing with relatively low

dispersion. The valuation process described above is used to corroborate the prices of these securities. The fair values of these

securities are generally classified as Level 2. These securities may be classified as Level 3 if the Company is unable to corroborate the

prices of these securities with a sufficient level of observable market data. In addition, certain corporate debt securities are classified

as Level 1 due to trading volumes sufficient to indicate an active market for the securities.

Smaller amounts of commercial paper and certificates of deposit, which generally have shorter maturities and less frequent trades, are

also grouped into this fixed income sector. Such securities are valued via mathematical calculations using observable inputs until such

time that market activity reflects an updated price. The fair values of these securities are typically classified as Level 2 measurements.

Asset-Backed and Mortgage-Backed Securities

Securities in this group include asset-backed securities, U.S. agency mortgage-backed securities, and other mortgage-backed

securities. These securities generally have lower levels of trading activity than government and agency debt securities and corporate

debt securities and, therefore, their fair values may be based on other inputs, such as spread data. The valuation process described

above is used to corroborate the prices of these securities. Fair value measurements of these investments are most often categorized as

Level 2; however, these securities are categorized as Level 3 when there is higher variability in the pricing data, a low number of

pricing sources, or the Company is otherwise unable to gather supporting information to conclude that the price can be transacted

upon in the market at the reporting date.

Money Market Funds

The money market funds in which the Company is invested are considered cash equivalents and are generally highly liquid

investments. Money market funds are valued at the per share (unit) published as the basis for current transactions.

Auction Rate Securities

All of the Company’s remaining auction rate securities were redeemed at par during 2014 and a discussion of the redemption of these

securities is provided below. As of December 31, 2014, the Company no longer holds any auction rate security investments.

In the first quarter of 2014, the Company’s auction rate preferred stock investment was fully redeemed at par and the municipal

auction rate security investment was fully redeemed at par in July 2014.

In previous quarters, the municipal auction rate security was classified as a Level 3 investment. In view of the impending redemption

of the security at par, the security was classified as a Level 2 measurement as of the beginning of the second quarter of 2014.

Derivatives

The Company employs a foreign currency and interest rate risk management strategy that periodically utilizes derivative instruments

to protect its interests from unanticipated fluctuations in earnings and cash flows caused by volatility in currency exchange rates and

interest rates. Fair values for the Company’s derivative financial instruments are based on pricing models or formulas using current

market data. Variables used in the calculations include forward points, spot rates, volatility assumptions and benchmark interest rates

at the time of valuation, as well as the frequency of payments to and from counterparties and effective and termination dates. The

Company believes there is minimal risk of nonperformance. At December 31, 2014 and 2013, all of the Company’s derivative

instruments were designated as Level 2 measurements in the fair value hierarchy. Refer to Note 18 of the Notes to Consolidated

Financial Statements for more information regarding the Company’s derivatives, including foreign exchange option contracts entered

into in 2014.

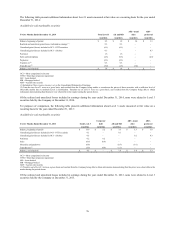

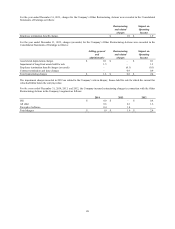

Senior Notes

The Company’s outstanding senior notes consist of $300 million of fixed rate senior unsecured notes issued in a public debt offering

in May 2008 and due on June 1, 2018 (the “2018 senior notes”) and $400 million of fixed rate senior unsecured notes issued in a

public debt offering completed in March 2013 and due on March 15, 2020 (the “2020 senior notes”).

The fair values shown in the table below are based on the prices at which the bonds have recently traded in the market as well as the

overall market conditions on the date of valuation, stated coupon rates, the number of coupon payments each year and the maturity

dates. The fair value of the debt is not recorded on the Company’s Consolidated Statements of Financial Position and is therefore

excluded from the fair value table above. This fair value measurement is classified as Level 2 within the fair value hierarchy.

78