Lexmark 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

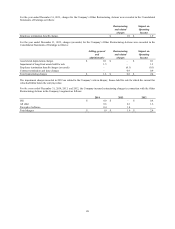

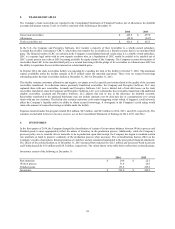

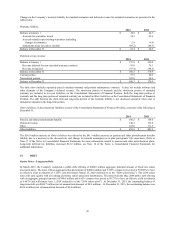

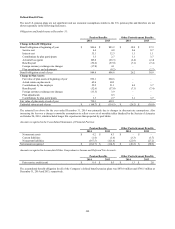

Changes in the Company’s warranty liability for standard warranties and deferred revenue for extended warranties are presented in the

tables below:

Warranty liability:

2014 2013

Balance at January 1 $ 30.5 $ 46.7

Accruals for warranties issued 58.3 62.6

Accruals related to pre-existing warranties (including

changes in estimates) 2.8 (9.5)

Settlements made (in cash or in kind) (69.2) (69.3)

Balance at December 31 $ 22.4 $ 30.5

Deferred service revenue:

2014 2013

Balance at January 1 $ 179.9 $ 192.0

Revenue deferred for new extended warranty contracts 93.8 76.1

Revenue recognized (93.4) (88.2)

Balance at December 31 $ 180.3 $ 179.9

Current portion 77.5 80.3

Non-current portion 102.8 99.6

Balance at December 31 $ 180.3 $ 179.9

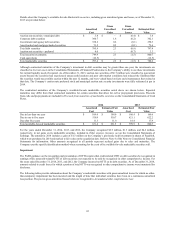

The table above includes separately priced extended warranty and product maintenance contracts. It does not include software and

other elements of the Company’s deferred revenue. The short-term portion of warranty and the short-term portion of extended

warranty are included in Accrued liabilities on the Consolidated Statements of Financial Position. Both the long-term portion of

warranty and the long-term portion of extended warranty are included in Other liabilities on the Consolidated Statements of Financial

Position. The split between the short-term and long-term portion of the warranty liability is not disclosed separately above due to

immaterial amounts in the long-term portion.

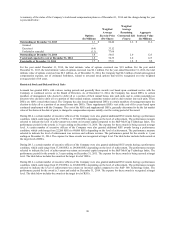

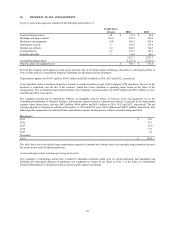

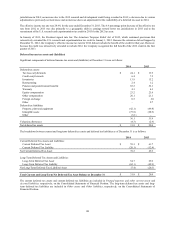

Other liabilities, in the noncurrent liabilities section of the Consolidated Statements of Financial Position, consisted of the following at

December 31:

2014 2013

Pension and other postretirement benefits $ 196.5 $ 154.6

Deferred revenue 140.3 135.8

Other 122.0 111.5

Other liabilities $ 458.8 $ 401.9

The $56.9 million increase in Other liabilities was driven by the $41.9 million increase in pension and other postretirement benefits

liability due to a decrease in the discount rate and change in actuarial assumption as to plan participants’ life expectancy. Refer to

Note 17 of the Notes to Consolidated Financial Statements for more information related to pension and other postretirement plans.

Long-term deferred tax liabilities increased $12.2 million, see Note 14 of the Notes to Consolidated Financial Statements for

additional information.

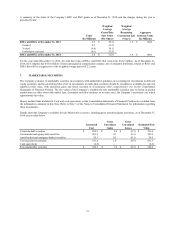

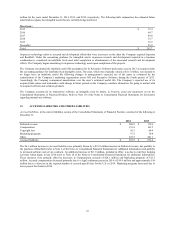

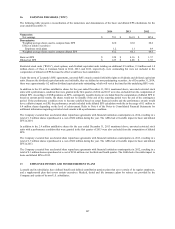

13. DEBT

Senior Notes – Long-term Debt

In March 2013, the Company completed a public debt offering of $400.0 million aggregate principal amount of fixed rate senior

unsecured notes. The notes with an aggregate principal amount of $400.0 million and 5.125% coupon were priced at 99.998% to have

an effective yield to maturity of 5.125% and will mature March 15, 2020 (referred to as the “2020 senior notes”). The 2020 senior

notes will rank equally with all existing and future senior unsecured indebtedness. The notes from the May 2008 public debt offering

with an aggregate principal amount of $300.0 million and 6.65% coupon were priced at 99.73% to have an effective yield to maturity

of 6.687% and will mature June 1, 2018 (referred to as the “2018 senior notes”). At December 31, 2014, the outstanding balance of

long-term debt was $699.7 million (net of unamortized discount of $0.3 million). At December 31, 2013, the outstanding balance was

$699.6 million (net of unamortized discount of $0.4 million).

98