Lexmark 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.New legislation, fees on the Company’s products or litigation costs required to protect the Company’s rights may negatively impact

the Company’s cost structure, access to components and operating results.

Certain countries (primarily in Europe) and/or collecting societies representing copyright owners’ interests have commenced

proceedings to impose fees on devices (such as scanners, printers and multifunction devices) alleging the copyright owners

are entitled to compensation because these devices enable reproducing copyrighted content. Other countries are also

considering imposing fees on certain devices. The amount of fees, if imposed, would depend on the number of products sold

and the amounts of the fee on each product, which will vary by product and by country. The financial impact on the

Company, which will depend in large part upon the outcome of local legislative processes, the Company’s and other industry

participants’ outcome in contesting the fees and the Company’s ability to mitigate that impact by increasing prices, which

ability will depend upon competitive market conditions, remains uncertain. The outcome of the copyright fee issue could

adversely affect the Company’s operating results and business.

The Company’s inability to perform satisfactorily under service contracts for managed print services or software services may

negatively impact the Company’s strategy and operating results.

The Company’s inability to perform satisfactorily under service contracts for managed print services and other customer

services may result in the loss of customers, loss of reputation and/or financial consequences that may have a material

adverse impact on the Company’s financial results and strategy.

The inability to attract, retain and motivate key employees could adversely affect the Company’s operating results.

In order to compete, the Company must attract, retain, and motivate executives and other key employees, and its failure to do

so could harm the Company’s results of operations. Hiring and retaining qualified executives, engineers, technical staff,

sales, marketing and IT support positions are critical to the Company’s business, and competition for experienced employees

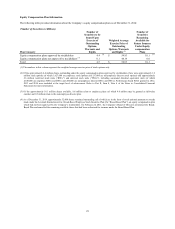

in Lexmark’s industry can be intense. To help attract, retain, and motivate qualified employees, the Company must offer a

competitive compensation package, including cash, cash-based incentive awards and share-based incentive awards, such as

restricted stock units. Because the cash-based and share-based incentive awards are dependent upon the performance

conditions relating to the Company’s performance and the performance of the price of the Company’s common stock, the

future value of such awards are uncertain. If the anticipated value of such incentive awards does not materialize, or if the

total compensation package ceases to be viewed as competitive, the Company’s ability to attract, retain, and motivate

employees could be weakened, which could harm the Company’s results of operations.

Terrorist acts, acts of war or other political conflicts may negatively impact the Company’s ability to manufacture and sell its

products.

Terrorist attacks and the potential for future terrorist attacks have created many political and economic uncertainties, some of

which may affect the Company’s future operating results. Future terrorist attacks, the national and international responses to

such attacks, and other acts of war or hostility may affect the Company’s facilities, employees, suppliers, customers,

transportation networks and supply chains, or may affect the Company in ways that are not capable of being predicted

presently.

Any variety of factors unrelated to the Company’s operating performance may negatively impact the Company’s operating results or

the Company’s stock price.

Factors unrelated to the Company’s operating performance, including the financial failure or loss of significant customers,

resellers, manufacturing partners or suppliers; the outcome of pending and future litigation or governmental proceedings; and

the ability to retain and attract key personnel, could also adversely affect the Company’s operating results. In addition, the

Company’s stock price, like that of other technology companies, can be volatile. Trading activity in the Company’s common

stock, particularly the trading of large blocks and intraday trading in the Company’s common stock, may affect the

Company’s common stock price.

Item 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

Item 2. PROPERTIES

Lexmark’s corporate headquarters and principal development facilities are located on a 374 acre campus in Lexington, Kentucky.

Perceptive Software’s headquarters is located in Lenexa, Kansas. At December 31, 2014, the Company owned or leased

21