Lexmark 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

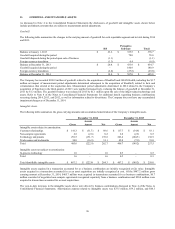

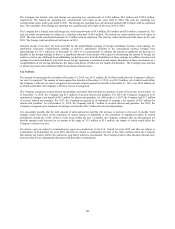

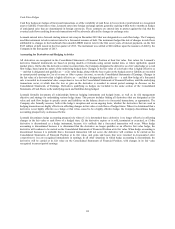

For the year ended December 31, 2014, the following table provides details of amounts reclassified from Accumulated other

comprehensive earnings (loss):

Details about Accumulated Other

Comprehensive Earnings Components

Amount Reclassified

from Accumulated

Other Comprehensive

(Loss) Earnings Affected Line Item in the Statements of Earnings

Pension and other postretirement benefits

Amortization of prior service benefit $ 0.7 Note 17. Employee Pension and Postretirement Plans

(0.3) Tax benefit (liability)

$ 0.4 Net of tax

Unrealized gains and (losses) on marketable

securities

Non-OTTI $ 2.8 Other expense (income), net

OTTI 0.2 Other expense (income), net

(0.3) Tax benefit (liability)

$ 2.7 Net of tax

Total reclassifications for the period $ 3.1 Net of tax

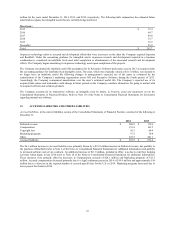

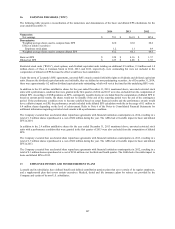

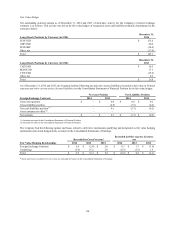

For the year ended December 31, 2013, the following table provides details of amounts reclassified from Accumulated other

comprehensive earnings (loss):

Details about Accumulated Other

Comprehensive Earnings Components

Amount Reclassified

from Accumulated

Other Comprehensive

(Loss) Earnings Affected Line Item in the Statements of Earnings

Foreign currency translation adjustment

Foreign exchange gain recognized upon

sale of a foreign entity $ 10.7 Gain on sale of inkjet-related technology and assets

Pension and other postretirement benefits

Amortization of prior service benefit $ 0.7 Note 17. Employee Pension and Postretirement Plans

Pension-related losses recognized upon

sale of a subsidiary (0.4) Gain on sale of inkjet-related technology and assets

(0.3) Tax benefit (liability)

$ – Net of tax

Unrealized gains and (losses) on

marketable securities

Non-OTTI $ 1.2 Other (income) expense, net

OTTI 0.1 Other (income) expense, net

(0.2) Tax benefit (liability)

$ 1.1 Net of tax

Total reclassifications for the period $ 11.8 Net of tax

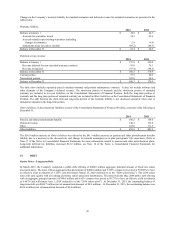

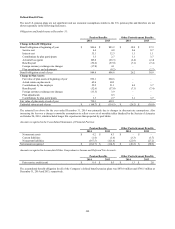

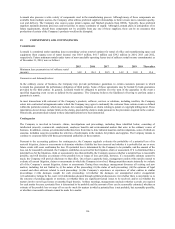

Net Other comprehensive earnings (loss) for 2012 include amounts reclassified from Accumulated other comprehensive earnings

(loss). Refer to Note 17 of the Notes to Consolidated Financial Statements for additional information regarding pension and other

postretirement plans, including the amounts amortized out of Accumulated other comprehensive earnings (loss) into net periodic

benefit cost for the periods presented. Refer to Note 18 of the Notes to Consolidated Financial Statements for additional information

regarding the Company’s cash flow hedging activity, including realized gains and losses reclassified from Accumulated other

comprehensive earnings (loss) into Net earnings for the periods presented. Refer to Note 7 of the Notes to Consolidated Financial

Statements for additional information regarding the Company’s investments in marketable securities, including realized gains and

losses reclassified from Accumulated other comprehensive earnings (loss) into Net earnings for the periods presented.

106