Lexmark 2014 Annual Report Download - page 126

Download and view the complete annual report

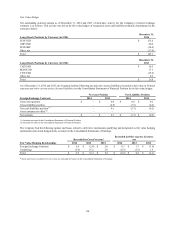

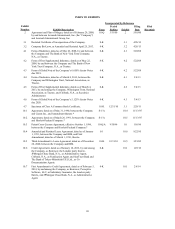

Please find page 126 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net earnings for the third quarter of 2014 included $11.7 million of pre-tax restructuring charges and project costs in connection with the

Company’s restructuring plans and $27.4 million of pre-tax charges in connection with intangible amortization and integration costs associated

with the Company’s acquisitions.

Net loss for the fourth quarter of 2014 included $10.4 million of pre-tax restructuring charges and project costs in connection with the

Company’s restructuring plans, $29.0 million of pre-tax charges in connection with intangible amortization and integration costs associated with

the Company’s acquisitions, and a pension and other postretirement benefit plan net loss of $83.4 million.

(2) Net earnings for the first quarter of 2013 included $9.1 million of pre-tax restructuring charges and project costs in connection with the

Company’s restructuring plans and $15.7 million of pre-tax charges in connection with intangible amortization and integration costs associated

with the Company’s acquisitions.

Net earnings for the second quarter of 2013 included a $73.5 million pretax Gain on sale of inkjet-related technology and assets, $13.3 million of

pre-tax restructuring charges and project costs in connection with the Company’s restructuring plans and $16.2 million of pre-tax charges in

connection with intangible amortization and integration costs associated with the Company’s acquisitions.

Net earnings for the third quarter of 2013 included $17.7 million of pre-tax restructuring charges and project costs in connection with the

Company’s restructuring plans and $19.1 million of pre-tax charges in connection with intangible amortization and integration costs associated

with the Company’s acquisitions.

Net earnings for the fourth quarter of 2013 included $14.4 million of pre-tax restructuring charges and project costs in connection with the

Company’s restructuring plans, $23.5 million of pre-tax charges in connection with intangible amortization and integration costs associated with

the Company’s acquisitions, and a pension and other postretirement benefit plan net gain of $83.0 million.

122