Lexmark 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

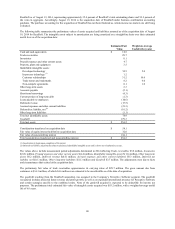

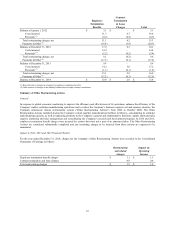

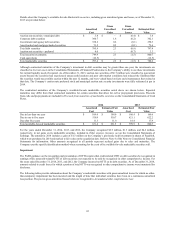

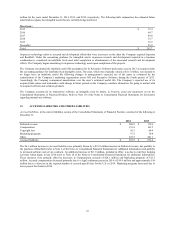

Liability Rollforward

The following table represents a rollforward of the liability incurred for employee termination benefits and contract termination and

lease charges in connection with the Company’s Other Restructuring Actions.

Contract

Employee Termination

Termination & Lease

Benefits Charges Total

Balance at January 1, 2012 $ 7.3 $ – $ 7.3

Costs incurred 0.6 0.9 1.5

Reversals (1) (1.0) – (1.0)

Total restructuring charges, net (0.4) 0.9 0.5

Payments & Other (2) (4.1) (0.2) (4.3)

Balance at December 31, 2012 2.8 0.7 3.5

Costs incurred 2.0 – 2.0

Reversals (1) (0.1) – (0.1)

Total restructuring charges, net 1.9 – 1.9

Payments & Other (2) (3.3) (0.6) (3.9)

Balance at December 31, 2013 1.4 0.1 1.5

Costs incurred 1.3 0.8 2.1

Reversals (1) (0.2) – (0.2)

Total restructuring charges, net 1.1 0.8 1.9

Payments & Other (2) (2.5) (0.9) (3.4)

Balance at December 31, 2014 $ – $ – $ –

(1) Reversals due to changes in estimates for employee termination benefits.

(2) Other consists of changes in the liability balance due to foreign currency translations.

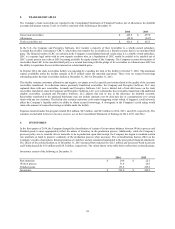

6. STOCK-BASED COMPENSATION

Lexmark has various stock incentive plans to encourage employees and nonemployee directors to remain with the Company and to

more closely align their interests with those of the Company’s stockholders. As of December 31, 2014, awards under the programs

consisted of stock options, RSUs, and DSUs, as well as DEUs. The Company currently issues the majority of shares related to its

stock incentive plans from the Company’s authorized and unissued shares of Class A Common Stock. Approximately 59.0 million

shares of Class A Common Stock have been authorized for these stock incentive plans. The Company also grants cash-based long-

term incentive awards based on the Company’s relative total shareholder return.

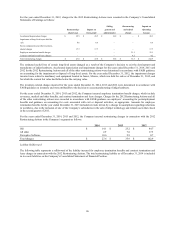

For the years ended December 31, 2014, 2013 and 2012, the Company incurred pre-tax stock-based compensation expense of $30.5

million, $28.3 million and $23.9 million, respectively, in the Consolidated Statements of Earnings. For the years ended December 31,

2014, 2013 and 2012, $2.6 million, $1.7 million and $0.4 million, respectively, was recognized for the cash-based long-term incentive

awards and is included in pre-tax stock-based compensation expense.

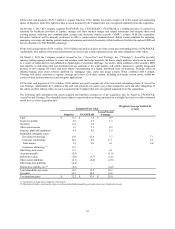

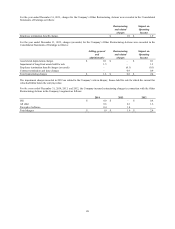

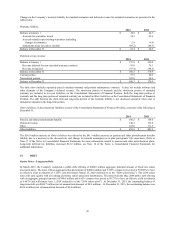

The following table presents a breakout of the stock-based compensation expense recognized for the years ended December 31:

2014 2013 2012

Cost of revenue $ 1.8 $ 2.3 $ 2.1

Research and development 5.5 3.6 4.1

Selling, general and administrative 23.2 22.4 17.7

Stock-based compensation expense before income taxes 30.5 28.3 23.9

Income tax benefit (11.5) (10.6) (9.2)

Stock-based compensation expense after income taxes $ 19.0 $ 17.7 $ 14.7

Stock Options

Generally, stock options expire ten years from the date of grant. No stock options were granted during 2014, 2013, or 2012.

89