Lexmark 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

Market Information

Lexmark’s Class A Common Stock is traded on the New York Stock Exchange under the symbol “LXK.” As of February 13, 2015,

there were 1,652 holders of record of the Class A Common Stock and there were no holders of record of the Class B Common Stock.

Information regarding the market prices of the Company’s Class A Common Stock appears in Part II, Item 8, Note 22 of the Notes to

Consolidated Financial Statements.

Dividend Policy

Dividends of $0.30 per common share were declared on February 21, 2013, April 25, 2013, July 25, 2013, October 24, 2013 and

February 20, 2014. Dividends of $0.36 per common share were declared on April 24, 2014, July 24, 2014, October 23, 2014 and

February 19, 2015. Refer to Part II, Item 8, Notes 15 and 21 of the Notes to Consolidated Financial Statements for more information

regarding dividends.

Lexmark is continuing to execute on its stated capital allocation framework of returning, on average, more than 50 percent of free cash

flow (net cash flows provided by operating activities minus purchases of property, plant and equipment plus proceeds from sale of

fixed assets) to its shareholders through dividends and share repurchases while pursuing acquisitions and organic investments that

support the strengthening and growth of the Company. The Company anticipates paying dividends quarterly, though future

declarations of dividends are subject to Board of Directors’ approval and may be adjusted as business needs or market conditions

change.

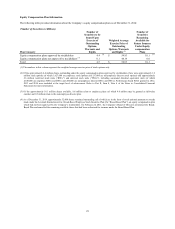

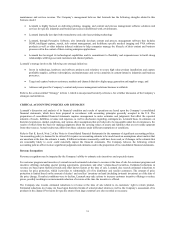

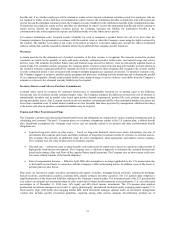

Issuer Purchases of Equity Securities

Period

Total Number of

Shares Purchased

(2)

Average Price

Paid per Share

(2)

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs (2)

Approximate

Dollar Value of

Shares that May

Yet Be Purchased

Under the Plans or

Programs (in

millions) (1)(2)

October 1-31, 2014 460,591 $ 40.60 460,591 $ 92.2

November 1-30, 2014 62,481 52.82 62,481 88.9

December 1-31, 2014 – – – 88.9

Total 523,072 $ 42.06 523,072

(1) Information regarding the Company’s share repurchases can be found in Part II, Item 8, Note 15 of the Notes to Consolidated

Financial Statements.

(2) On October 24, 2014, the Company entered into an Accelerated Share Repurchase (“ASR”) Agreement with a financial institution

counterparty. Under the terms of the ASR Agreement, the Company paid $22 million targeting approximately 0.5 million shares

based on the closing price of the Company’s Class A Common Stock on October 24, 2014. On October 29, 2014, the Company

took delivery of 85% of the shares, or approximately 0.5 million shares at a cost of $18.7 million. On November 21, 2014, the

counterparty delivered approximately 0.1 million additional shares in final settlement of the agreement, bringing the total shares

repurchased under the ASR to approximately 0.5 million shares at an average price per share of $42.06.

23