Lexmark 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

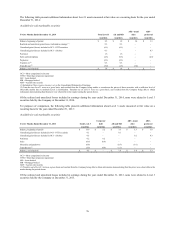

Net Earnings Per Share:

Basic net earnings per share is calculated by dividing net income by the weighted average number of shares outstanding during the

reported period. The calculation of diluted net earnings per share is similar to basic, except that the weighted average number of shares

outstanding includes the additional dilution from potential common stock such as stock options, restricted stock units, and dividend

equivalents.

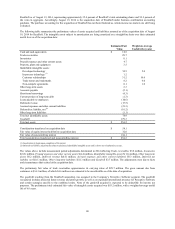

Accumulated Other Comprehensive (Loss) Earnings:

Accumulated other comprehensive (loss) earnings refers to revenues, expenses, gains and losses that under U.S. GAAP are included in

comprehensive (loss) earnings but are excluded from net income as these amounts are recorded directly as an adjustment to

stockholders’ equity, net of tax. Lexmark’s Accumulated other comprehensive (loss) earnings is composed of unrealized gains on cash

flow hedges, unamortized prior service cost or credit related to pension or other postretirement benefits, foreign currency translation

adjustments and net unrealized gains and losses on marketable securities including the non-credit loss component of OTTI. The

Company presents each item of other comprehensive (loss) earnings, on a net basis, and related tax amounts in the Consolidated

Statements of Comprehensive Earnings, displaying the combination of reclassification adjustments and other changes as a single

amount. Reclassification adjustments, including related tax amounts, are disclosed in Note 15 of the Notes to Consolidated Financial

Statements. For any item required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting period, the

affected line item(s) on the Consolidated Statements of Earnings are provided. For other amounts not required to be reclassified to net

income in their entirety, such as pension-related amounts, the Company provides in Note 15 a cross-reference to related footnote

disclosures.

Recent Accounting Pronouncements:

Accounting Standards Updates Recently Issued and Effective

In July 2013, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2013-11, Income Taxes

(Topic 740): Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax

Credit Carryforward Exists (“ASU 2013-11”). ASU 2013-11 requires that unrecognized tax benefits be presented as a reduction to

deferred tax assets for all same jurisdiction loss or other tax carryforwards that are available and would be used by the entity to settle

additional income taxes resulting from disallowance of the uncertain tax position. The amendments in ASU 2013-11 became effective

for the Company’s fiscal year beginning January 1, 2014 and were applied prospectively, which resulted in a reduction of

approximately $1 million to Other assets and Other liabilities upon adoption. The amendments in ASU 2013-11 did not have a

material effect on the Company’s Consolidated Statement of Financial Position as of December 31, 2014.

Accounting Standards Updates Recently Issued But Not Yet Effective

In April 2014, the FASB issued Accounting Standards Update No. 2014-08, Presentation of Financial Statements (Topic 205) and

Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an

Entity (“ASU 2014-08”). Under ASU 2014-08, only a disposal of a component or a group of components that represents a strategic

shift that has (or will have) a major effect on an entity’s operations and financial results will qualify as a discontinued operation. In

addition, under the revised definition, reporting discontinued operations will no longer be precluded when the operations and cash

flows of the disposed component have not been eliminated from ongoing operations or when there is significant continuing

involvement with the component after disposal. The amendments in ASU 2014-08 will be effective prospectively for the Company in

the first quarter of 2015. The Company does not anticipate a material impact to its financial statements from ASU 2014-08, absent any

disposals of components or groups of components that represent a strategic shift having a major effect on the Company’s operations

and financial results in future periods.

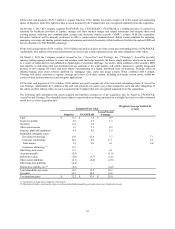

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”). ASU

2014-09 is a new comprehensive standard for revenue recognition that is based on the core principle that revenue be recognized in a

manner that depicts the transfer of goods or services to customers in an amount that reflects the consideration to which the entity

expects to be entitled in exchange for those goods or services. Under the new standard, a good or service is transferred to the customer

when (or as) the customer obtains control of the good or service, which differs from the risk and rewards approach under current

guidance. The new standard provides guidance for transactions that were not previously addressed comprehensively, including service

revenue and contract modifications, eliminates industry-specific revenue recognition guidance, including that for software, and

requires enhanced disclosures about revenue. ASU 2014-09 affects any entity that enters into contracts with customers to transfer

goods or services, except for certain contracts within the scope of other standards (such as leases), and is also applicable to transfers of

nonfinancial assets outside of the entity’s ordinary activities. Areas of potential change for the Company include, but are not limited

to, units of accounting, the determination of the transaction price, the allocation of the transaction price to multiple goods and services,

transfer of control, software licenses, and capitalization of contract costs.

73