Lexmark 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

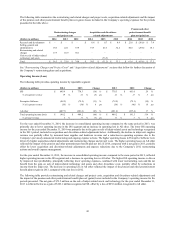

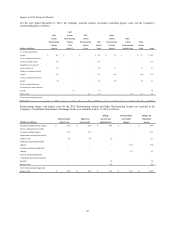

Cash conversion days

2014 2013 2012

Days of sales outstanding 37 40 49

Days of inventory 34 41 39

Days of payables 72 73 72

Cash conversion days (1) 9 16

Cash conversion days represent the number of days that elapse between the day the Company pays for materials and the day it collects

cash from its customers. Cash conversion days are equal to the days of sales outstanding plus days of inventory less days of payables.

The days of sales outstanding are calculated using the period-end Trade receivables balance, net of allowances, and the average daily

revenue for the quarter.

The days of inventory are calculated using the period-end net Inventories balance and the average daily cost of revenue for the quarter.

The days of payables are calculated using the period-end Accounts payable balance and the average daily cost of revenue for the

quarter.

Cash conversion days presented above may not be comparable to similarly titled measures reported by other registrants. The cash

conversion days in the table above may not foot due to rounding. The 2014 cash conversion days were exceptional; the Company

does not expect to maintain the same level of performance in 2015. Cash conversion days in early 2015 will likely align closer to

prior trends.

Investing activities

The $253.4 million decrease in net cash flows used for investing activities during 2014 compared to that of 2013 was driven by the

$226.2 million increase in proceeds from marketable securities, the decrease in business acquisitions of $62.9 million, a $30.5 million

decrease in purchases of marketable securities and decreased property, plant and equipment purchases of $31.1 million. These

activities were partially offset by the proceeds from the sale of inkjet-related technology and assets of $97.6 million in the 2013

period.

The $6.9 million increase in net cash flows used for investing activities during 2013 compared to that of 2012 was driven by the

$267.7 million decrease in proceeds from marketable securities offset by the decrease in business acquisitions of $99.3 million, a

$68.3 million decrease in purchases of marketable securities and proceeds from the sale of inkjet-related technology and assets of

$97.6 million.

The Company’s business acquisitions, marketable securities and capital expenditures are discussed below.

Business acquisitions

In 2014, cash flow used to acquire businesses was higher than 2013 due to the acquisitions of ReadSoft and GNAX Health at a total

net investment of $238.1 million compared to AccessVia, Twistage, Saperion and PACSGEAR at a total net purchase price of $146.1

million. ReadSoft is a leading global provider of software solutions that automate business processes, both on premise and in the

cloud. The Company purchased a controlling interest in ReadSoft for an initial net investment of $79.3 million. The company

continued to purchase stock in ReadSoft throughout 2014 for an additional investment of $154.9 million, included in Financing

activities. In accordance with Swedish law, the Company requested a compulsory purchase of the outstanding minority shares in

ReadSoft, and anticipates obtaining pre-title to the remaining minority shares in March 2015. GNAX Health is a provider of image

exchange software technology for exchanging medical content between medical facilities.

In 2013, cash flow used to acquire businesses was lower than 2012 due to the acquisitions of AccessVia, Twistage, Saperion and

PACSGEAR at a total net purchase price of $146.1 million compared to Brainware, ISYS, Nolij, and Acuo, which were acquired in

2012 for $245.4 million. AccessVia provides industry-leading signage solutions to create and produce retail shelf-edge materials, all

from a single platform, which can be directed to a variety of output devices and published to digital signs or electronic shelf tags.

Twistage offers an industry-leading, pure cloud software platform for managing video, audio and image content. Saperion is a

European-based leader in ECM solutions, focused on providing document archive and workflow solutions. PACSGEAR is a leading

provider of connectivity solutions for healthcare providers to capture, manage and share medical images and related documents and

integrate them with existing picture archiving and communication systems and EMR systems.

Subsequent to the date of the financial statements, the Company acquired substantially all the assets of Claron Technology, Inc.

(“Claron”). Claron is a leading provider of medical image viewing, distribution, sharing and collaboration software technology.

52