Lexmark 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

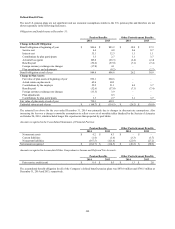

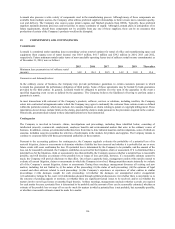

Defined Benefit Plans

The non-U.S. pension plans are not significant and use economic assumptions similar to the U.S. pension plan and therefore are not

shown separately in the following disclosures.

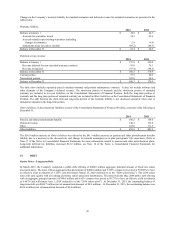

Obligations and funded status at December 31:

Pension Benefits Other Postretirement Benefits

2014 2013 2014 2013

Change in Benefit Obligation:

Benefit obligation at beginning of year $ 806.6 $ 883.2 $ 30.9 $ 37.9

Service cost 4.4 4.8 0.6 0.7

Interest cost 35.1 32.3 1.1 1.1

Contributions by plan participants 3.3 2.7 3.1 3.7

Actuarial loss (gain) 105.8 (63.3) (2.4) (2.4)

Benefits paid (52.6) (57.0) (7.1) (7.4)

Foreign currency exchange rate changes (17.8) 4.1 – –

Plan amendments and adjustments – (0.2) – (2.7)

Benefit obligation at end of year 884.8 806.6 26.2 30.9

Change in Plan Assets:

Fair value of plan assets at beginning of year 692.1 660.6 – –

Actual return on plan assets 65.6 60.3 – –

Contributions by the employer 25.2 21.1 4.0 3.7

Benefits paid (52.6) (57.0) (7.1) (7.4)

Foreign currency exchange rate changes (13.5) 3.9 – –

Plan adjustments – 0.5 – –

Contributions by plan participants 3.3 2.7 3.1 3.7

Fair value of plan assets at end of year 720.1 692.1 – –

Unfunded status at end of year $ (164.7) $ (114.5) $ (26.2) $ (30.9)

The actuarial loss above for the year ended December 31, 2014 was primarily due to changes in discount rate assumptions. Also

increasing the loss was a change in mortality assumptions to reflect a new set of mortality tables finalized by the Society of Actuaries

on October 24, 2014, which included longer life expectancies than projected by past tables.

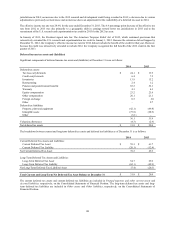

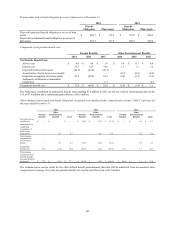

Amounts recognized in the Consolidated Statements of Financial Position:

Pension Benefits Other Postretirement Benefits

2014 2013 2014 2013

Noncurrent assets $ 4.2 $ 8.3 $ – $ –

Current liabilities (1.4) (1.4) (3.3) (3.7)

Noncurrent liabilities (167.5) (121.4) (22.9) (27.2)

Net amount recognized $ (164.7) $ (114.5) $ (26.2) $ (30.9)

Amounts recognized in Accumulated Other Comprehensive Income and Deferred Tax Accounts:

Pension Benefits Other Postretirement Benefits

2014 2013 2014 2013

Prior service credit (cost) $0.4 $0.5 $ 1.3 $2.0

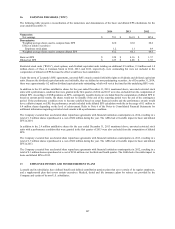

The accumulated benefit obligation for all of the Company’s defined benefit pension plans was $870.0 million and $798.5 million at

December 31, 2014 and 2013, respectively.

108