Lexmark 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

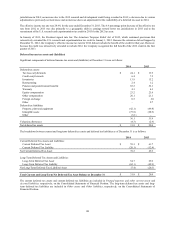

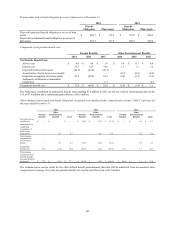

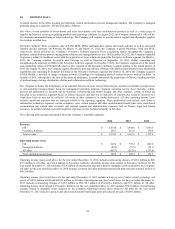

The following table sets forth by level, within the fair value hierarchy, plan assets measured at fair value on a recurring basis as of

December 31, 2014 and 2013:

December 31, 2014 December 31, 2013

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Commingled trust

funds:

Fixed income $ – $ 251.1 $ – $ 251.1 $ – $ 210.1 $ – $ 210.1

International equity

large-cap – 82.3 – 82.3 – 92.9 – 92.9

International equity

small-cap – 17.3 – 17.3 – 20.8 – 20.8

Emerging market

equity – 21.7 – 21.7 – 24.5 – 24.5

Emerging market

debt – 25.7 – 25.7 – 26.6 – 26.6

Global equity – 36.0 – 36.0 – 39.2 – 39.2

U.S. equity – 83.0 – 83.0 – 89.8 – 89.8

Real estate – 5.1 – 5.1 – 4.8 – 4.8

Fixed income:

Government and

agency debt

securities – 33.4 – 33.4 – 33.0 – 33.0

Corporate debt

securities – 144.1 1.2 145.3 – 133.0 1.6 134.6

Asset-backed and

mortgage-backed

securities – 9.7 3.1 12.8 – 11.1 2.5 13.6

U.S. equity securities:

Cash equivalent – 4.4 – 4.4 – 2.3 – 2.3

Subtotal – 713.8 4.3 718.1 – 688.1 4.1 692.2

Cash – – – 2.0 – – – 2.2

Employer and

benefits payable – – – – – – – (2.3)

Total assets at fair

value $ – $ 713.8 $ 4.3 $ 720.1 $ – $ 688.1 $ 4.1 $ 692.1

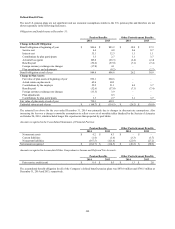

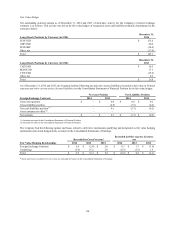

The following table sets forth a summary of changes in the fair value of Level 3 assets at December 31:

2014 2013

Total

Fixed Income

- Corporate

debt securities

Fixed Income

- Asset-backed

and mortgage-

backed

securities Total

Fixed Income

- Corporate

debt securities

Fixed Income

- Asset-

backed and

mortgage-

backed

securities

Fair value at beginning of

year $ 4.1 $ 1.6 $ 2.5 $ 2.0 $ 2.0 $ –

Actual return on plan assets -

assets held at reporting date 0.1 0.1 – – – –

Actual return on plan assets -

assets sold during period – – – (0.1) – (0.1)

Purchases, sales and

settlements, net 0.1 (0.5) 0.6 2.6 – 2.6

Transfers in/(transfers out),

net – – – (0.4) (0.4) –

Fair value at end of year $ 4.3 $ 1.2 $ 3.1 $ 4.1 $ 1.6 $ 2.5

111