Lexmark 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

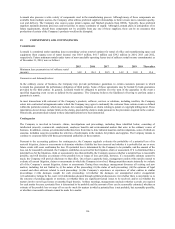

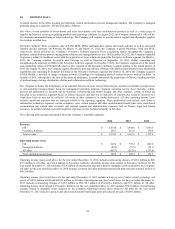

20. SEGMENT DATA

Lexmark operates in the office imaging and enterprise content and business process management markets. The Company is managed

primarily along two segments: ISS and Perceptive Software.

ISS offers a broad portfolio of monochrome and color laser printers and laser multifunction products as well as a wide range of

supplies and services covering its printing products and technology solutions. In August 2012, the Company announced it will exit the

development and manufacturing of inkjet technology. The Company will continue to provide service, support and aftermarket supplies

for its inkjet installed base.

Perceptive Software offers a complete suite of ECM, BPM, DOM, intelligent data capture and search software as well as associated

industry specific solutions. On February 29, March 13, and March 16, 2012, the Company acquired Brainware, Nolij and ISYS,

respectively, which all joined the Company’s Perceptive Software segment. These acquisitions further strengthen the Company’s

products, content/business process management solutions and managed print services. On December 28, 2012, the Company expanded

its presence within the healthcare sector with the acquisition of Acuo which also joined the Perceptive Software segment. On March 1,

2013, the Company acquired AccessVia and Twistage as well as Saperion on September 16, 2013, further expanding and

strengthening the solutions available in the Perceptive Software segment. On October 3, 2013, the Company acquired all of the issued

and outstanding shares of PACSGEAR which is also reported in the Perceptive Software segment starting in the fourth quarter of

2013. On August 19, 2014, the Company acquired ReadSoft, growing software offerings with additional document process automation

capabilities and expanding its footprint in Europe in the Perceptive Software segment. On October 14, 2014, the Company acquired

GNAX Health, a provider of image exchange software technology for exchanging medical content between medical facilities. In

January of 2015, subsequent to the date of the financial statements, Lexmark announced the acquisition of Claron, a leading provider

of medical image viewing, distribution, sharing and collaboration software technology.

The Company evaluates the performance of its segments based on revenue and operating income, and does not include segment assets

or non-operating income/expense items for management reporting purposes. Segment operating income (loss) includes: selling,

general and administrative; research and development; restructuring and related charges; and other expenses, certain of which are

allocated to the respective segments based on internal measures and may not be indicative of amounts that would be incurred on a

stand-alone basis or may not be indicative of results of other enterprises in similar businesses. All other operating income (loss)

includes significant expenses that are managed outside of the reporting segments. These unallocated costs include such items as

information technology expenses, certain occupancy costs, certain pension and other postretirement benefit plan costs, stock-based

compensation and certain other corporate and regional general and administrative expenses such as finance, legal and human

resources. Acquisition-related costs and integration expenses are also included primarily in All other.

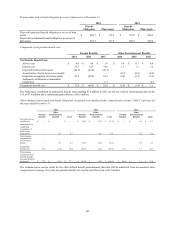

The following table includes information about the Company’s reportable segments:

2014 2013 2012

Revenue:

ISS $ 3,414.8 $ 3,444.0 $ 3,641.6

Perceptive Software 295.7 223.6 156.0

Total revenue $ 3,710.5 $ 3,667.6 $ 3,797.6

Operating income (loss):

ISS $ 645.4 $ 770.3 $ 601.0

Perceptive Software (88.5) (79.5) (72.1)

All other (407.7) (281.6) (337.4)

Total operating income (loss) $149.2 $ 409.2 $191.5

Operating income (loss) noted above for the year ended December 31, 2014 includes restructuring charges of $15.0 million in ISS,

$3.5 million in All other, and $11.0 million in Perceptive Software. Operating income (loss) related to Perceptive Software for the

year ended December 31, 2014 includes $72.8 million of amortization expense related to intangible assets acquired by the Company.

All other for the year ended December 31, 2014 includes a pension and other postretirement benefit plan asset and actuarial net loss of

$80.5 million.

Operating income (loss) noted above for the year ended December 31, 2013 includes a Gain on sale of inkjet-related technology and

assets of $103.1 million in ISS and $(29.6) million in All other. Operating income (loss) noted above for the year ended December 31,

2013 includes restructuring charges of $25.2 million in ISS, $4.7 million in Perceptive Software, and $7.9 million in All other.

Operating income (loss) related to Perceptive Software for the year ended December 31, 2013 includes $56.4 million of amortization

expense related to intangible assets acquired by the Company. Operating income (loss) related to All other for the year ended

December 31, 2013 includes a pension and other postretirement benefit plan asset and actuarial net gain of $83.0 million.

119