Lexmark 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Of the total cash payment of $72.3 million to acquire Saperion, $72.2 million was paid to acquire all of the issued and outstanding

shares of Saperion, while $0.1 million relates to assets acquired by the Company that were recognized separately from the acquisition.

On October 3, 2013 the Company acquired PACSGEAR, Inc. (“PACSGEAR”). PACSGEAR is a leading provider of connectivity

solutions for healthcare providers to capture, manage and share medical images and related documents and integrate them with

existing picture archiving and communication systems and electronic medical records (“EMR”) systems. With this acquisition,

Perceptive Software will be uniquely positioned to offer a vendor-neutral, standards-based clinical content platform for capturing,

managing, accessing and sharing patient imaging information and related documents within healthcare facilities through an EMR and

between facilities via PACSGEAR technology.

Of the total cash payment of $54.1 million, $53.9 million was paid to acquire all of the issued and outstanding shares of PACSGEAR.

Additionally, $0.2 million of the total cash payment was used to pay certain transaction costs and other obligations of the sellers.

On March 1, 2013 the Company acquired AccessVia, Inc. (“AccessVia”) and Twistage, Inc. (“Twistage”). AccessVia provides

industry-leading signage solutions to create and produce retail shelf-edge materials, all from a single platform, which can be directed

to a variety of output devices and published to digital signs or electronic shelf tags. AccessVia, when combined with Lexmark’s MPS

and expertise in delivering print and document process solutions to the retail market, will enable customers to quickly design and

produce in-store signage for better and more timely merchandising in a highly distributed store environment. Twistage offers an

industry-leading, pure cloud software platform for managing video, audio and image content. When combined with Lexmark,

Twistage will enable customers to capture, manage and access all of their content, including rich media content assets, within the

context of their business processes and enterprise applications.

Of the total cash payment of $31.5 million, $29.0 million was paid to acquire all of the issued and outstanding shares of AccessVia

and Twistage. Additionally, $2.3 million of the total cash payment was used to pay certain transaction costs and other obligations of

the sellers and $0.2 million relates to assets acquired by the Company that were recognized separately from the acquisitions.

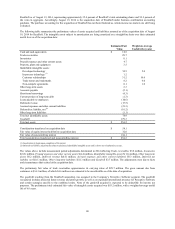

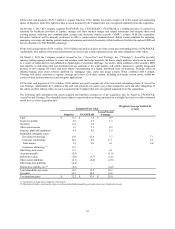

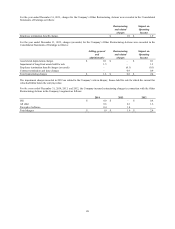

The following table summarizes the assets acquired and liabilities assumed as of the acquisition date for Saperion, PACSGEAR,

AccessVia and Twistage. The intangible assets subject to amortization are being amortized on a straight-line basis over their estimated

useful lives as of the acquisition date:

Estimated Fair Value

Weighted-Average Useful Life

(y

ears

)

Saperion PACSGEAR

AccessVia and

Twista

g

e

Cash $ 6.5 $ 1.6 $ 0.9

Trade receivables 3.0 2.7 1.3

Inventory 0.2 1.0 –

Other current assets 1.3 1.5 0.3

Property, plant and equipment 0.4 0.2 1.0

Identifiable intangible assets:

Developed technology 15.8 25.8 7.7 7.1

Customer relationships 19.4 2.9 11.1 6.7

Trade names 2.1 0.3 0.1 2.8

In-process technology (1) 0.5 – –

Other long-term assets 0.3 – 0.1

Accounts payable (0.5) – (1.5)

Deferred revenue (3.0) (1.7) (2.6)

Other current liabilities (4.1) (2.4) (2.0)

Other long-term liabilities (0.4) – –

Deferred tax liability, net (2) (8.5) – (4.2)

Total identifiable net assets 33.0 31.9 12.2

Goodwill 39.2 22.0 16.8

Total purchase price $ 72.2 $ 53.9 $ 29.0

(1) Amortization to begin upon completion of the project.

(2) Deferred tax liability, net primarily relates to purchased identifiable intangible assets and is shown net of deferred tax assets.

82