Lexmark 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

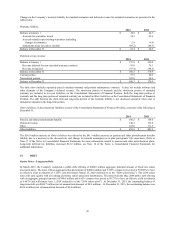

jurisdictions in 2014; an increase due to the 2012 research and development credit being recorded in 2013; a decrease due to various

adjustments to previously accrued taxes; and an increase due to an adjustment for the realizability of a deferred tax asset in 2014.

The effective income tax rate was 28.9% for the year ended December 31, 2013. The 4.9 percentage point decrease of the effective tax

rate from 2012 to 2013 was due primarily to a geographic shift in earnings toward lower tax jurisdictions in 2013 and to the

reenactment of the U.S. research and experimentation tax credit in 2013 for the 2012 tax year.

In January of 2013, the President signed into law The American Taxpayer Relief Act of 2012, which contained provisions that

retroactively extended the U.S. research and experimentation tax credit to January 1, 2012. Because the extension did not happen by

December 31, 2012, the Company’s effective income tax rate for 2012 did not include the benefit of the credit for that year. However,

because the credit was retroactively extended to include 2012, the Company recognized the full benefit of the 2012 credit in the first

quarter of 2013.

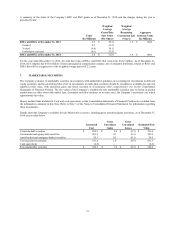

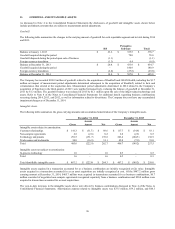

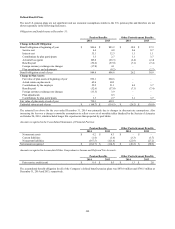

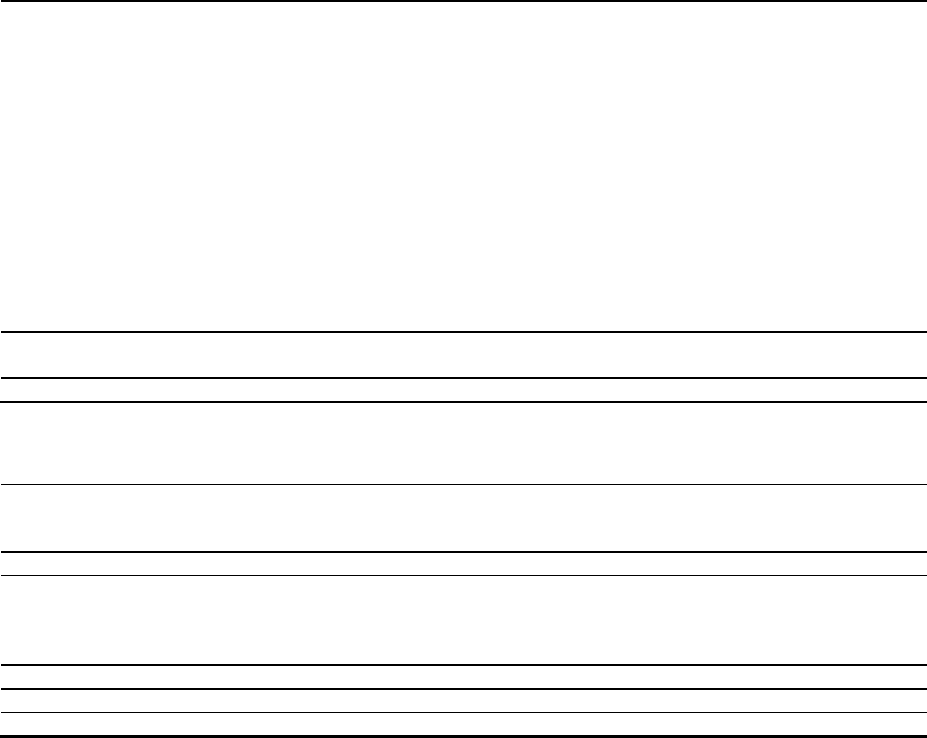

Deferred income tax assets and (liabilities)

Significant components of deferred income tax assets and (liabilities) at December 31 were as follows:

2014 2013

Deferred tax assets:

Tax loss carryforwards $ 24.1 $ 13.9

Credit carryforwards 6.4 7.5

Inventories 13.9 13.2

Restructuring 2.4 1.2

Pension and postretirement benefits 65.2 52.1

Warranty 4.3 4.3

Equity compensation 23.2 25.6

Other compensation 20.1 21.1

Foreign exchange 0.5 2.0

Other – 9.7

Deferred tax liabilities:

Property, plant and equipment (42.1) (49.8)

Intangible assets (75.8) (68.9)

Other (6.1) –

36.1 31.9

Valuation allowances (4.3) (2.9)

Net deferred tax assets $ 31.8 $ 29.0

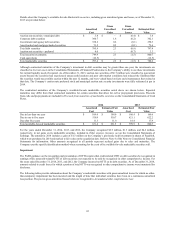

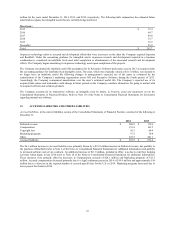

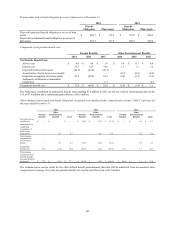

The breakdown between current and long-term deferred tax assets and deferred tax liabilities as of December 31 is as follows:

2014 2013

Current Deferred Tax Assets and Liabilities:

Current Deferred Tax Asset $ 59.3 $ 61.7

Current Deferred Tax Liability (20.1) (12.4)

Net Current Deferred Tax Asset 39.2 49.3

Long-Term Deferred Tax Assets and Liabilities:

Long-Term Deferred Tax Asset 54.7 29.6

Long-Term Deferred Tax Liability (62.1) (49.9)

Net Long-Term Deferred Tax (Liability) Asset (7.4) (20.3)

Total Current and Long-Term Net Deferred Tax Asset Balance at December 31 $ 31.8 $ 29.0

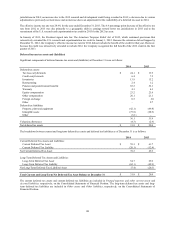

The current deferred tax assets and current deferred tax liabilities are included in Prepaid expenses and other current assets and

Accrued liabilities, respectively, on the Consolidated Statements of Financial Position. The long-term deferred tax assets and long-

term deferred tax liabilities are included in Other assets and Other liabilities, respectively, on the Consolidated Statements of

Financial Position.

101