Lexmark 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

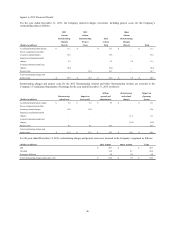

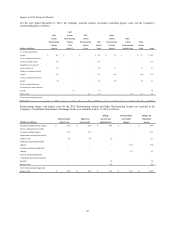

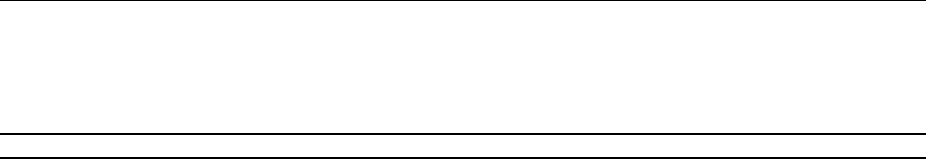

Contractual Cash Obligations

The following table summarizes the Company’s contractual obligations at December 31, 2014:

Less than More than

(Dollars in Millions) Total 1 Year 1-3 Years 3-5 Years 5 years

Long-term debt (1) $ 883 $ 41 $ 81 $ 351 $ 410

Operating leases 121 35 47 24 15

Purchase obligations 157 157 – – –

Uncertain tax positions 20 2 3 13 2

Pension and other postretirement plan contributions 15 15 – – –

Other long-term liabilities (2) 42 21 7 3 11

Total contractual obligations $ 1,238 $ 271 $ 138 $ 391 $ 438

(1) includes interest payments

(2) includes current portion of other long-term liabilities

Long-term debt reported in the table above includes principal repayments of $300 million and $400 million in the 3-5 Years and More

than 5 Years columns, respectively. All other amounts represent interest payments.

Purchase obligations reported in the table above include agreements to purchase goods or services that are enforceable and legally

binding on the Company and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed,

minimum or variable price provisions; and the approximate timing of the transaction.

Other long-term liabilities reported in the table above is made up of various items including asset retirement obligations and

restructuring reserves.

The Company’s funding policy for its pension and other postretirement plans is to fund minimum amounts according to the regulatory

requirements under which the plans operate. From time to time, the Company may choose to fund amounts in excess of the minimum

for various reasons. The Company is currently expecting to contribute approximately $15 million to its pension and other

postretirement plans in 2015, as noted in the table above. The Company anticipates similar levels of funding for 2016 and 2017 based

on factors that were present as of December 31, 2014. Actual future funding requirements beyond 2015 will be impacted by various

factors, including actual pension asset returns and interest rates used for discounting future liabilities and are, therefore, not included

in the table above. The effect of any future contributions the Company may be obligated or otherwise choose to make could be

material to the Company’s future cash flows from operations.

Waste Electrical and Electronic Equipment (“WEEE”) Directives issued by the European Union require producers of electrical and

electronic goods to be financially responsible for specified collection, recycling, treatment and disposal of past and future covered

products. The Company’s estimated financial obligation related to WEEE Directives is not shown in the table above due to the lack of

historical data necessary to project future dates of payment. At December 31, 2014, the Company’s estimated liability for this

obligation was a long-term liability of $2.4 million included in Other liabilities on the Consolidated Statements of Financial Position.

As of December 31, 2014, the Company had accrued $56.3 million for pending copyright fee issues, including litigation proceedings,

local legislative initiatives and/or negotiations with the parties involved. These accruals are included in Accrued liabilities on the

Consolidated Statements of Financial Position. The liability is not included in the table above due to the level of uncertainty regarding

the timing of payments and ultimate settlement of the litigation. Payment of such potential obligations could have a material impact on

the Company’s future operating cash flows. Refer to Part II, Item 8, Note 19 of the Notes to Consolidated Financial Statements for

additional information.

Capital Expenditures

Capital expenditures totaled $136.3 million, $167.4 million and $162.2 million in 2014, 2013 and 2012, respectively. The capital

expenditures for 2014 principally related to infrastructure support (including internal-use software expenditures), building and

improvements and new product development. The Company expects capital expenditures to be approximately $110 million for full

year 2015, attributable mostly to infrastructure support and new product development. Capital expenditures in 2015 are expected to be

funded through cash from operations; however, if necessary, the Company may use existing cash and cash equivalents, proceeds from

sales of marketable securities or additional sources of liquidity as discussed in the preceding sections.

56