Lexmark 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

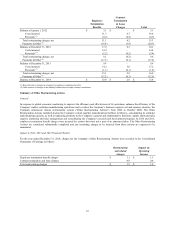

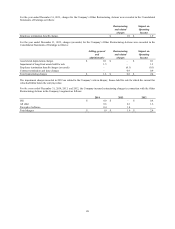

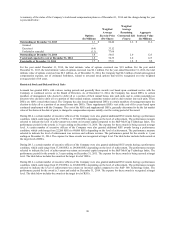

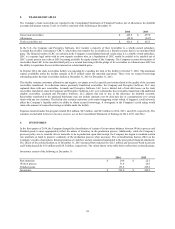

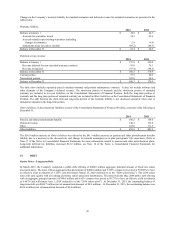

A summary of the status of the Company’s RSU and DSU grants as of December 31, 2014 and the changes during the year is

presented below:

Weighted Weighted

Average Average

Grant Date Remaining Aggregate

Units Fair Value Contractual Life Intrinsic Value

(In Millions) (Per Share) (Years) (In Millions)

RSUs and DSUs at December 31, 2013 2.8 $ 30.71 1.6 $ 100.5

Granted 0.7 41.21

Vested (0.8) 34.11

Forfeited or canceled (0.1) 32.52

RSUs and DSUs at December 31, 2014 2.6 $ 32.81 1.4 $ 108.5

For the year ended December 31, 2014, the total fair value of RSUs and DSUs that vested was $34.2 million. As of December 31,

2014, the Company had $41.0 million of total unrecognized compensation expense, net of estimated forfeitures, related to RSUs and

DSUs that will be recognized over the weighted average period of 2.2 years.

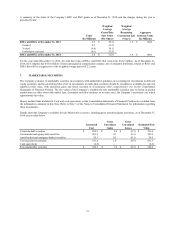

7. MARKETABLE SECURITIES

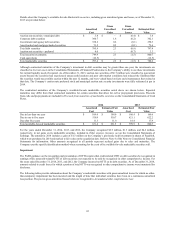

The Company evaluates its marketable securities in accordance with authoritative guidance on accounting for investments in debt and

equity securities, and has determined that all of its investments in marketable securities should be classified as available-for-sale and

reported at fair value, with unrealized gains and losses recorded in Accumulated other comprehensive loss on the Consolidated

Statements of Financial Position. The fair values of the Company’s available-for-sale marketable securities may be based on quoted

market prices or other observable market data, discounted cash flow analyses, or in some cases, the Company’s amortized cost, which

approximates fair value.

Money market funds included in Cash and cash equivalents on the Consolidated Statements of Financial Position are excluded from

the information contained in this Note. Refer to Note 3 of the Notes to Consolidated Financial Statements for information regarding

these investments.

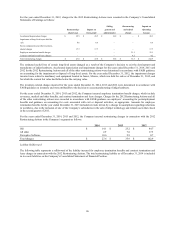

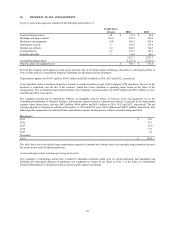

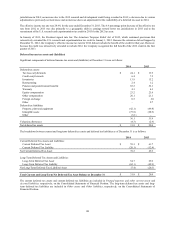

Details about the Company’s available-for-sale Marketable securities, including gross unrealized gains and losses, as of December 31,

2014 are provided below:

Gross Gross

Amortized Unrealized Unrealized Estimated Fair

Cost Gains Losses Value

Corporate debt securities $ 290.9 $ 0.6 $ (0.5) $ 291.0

Government and agency debt securities 281.2 0.1 (0.3) 281.0

Asset-backed and mortgage-backed securities 59.3 0.3 (0.1) 59.5

Total security investments 631.4 1.0 (0.9) 631.5

Cash equivalents (6.9) – – (6.9)

Total marketable securities $ 624.5 $ 1.0 $ (0.9) $ 624.6

91