Lexmark 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

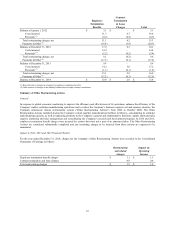

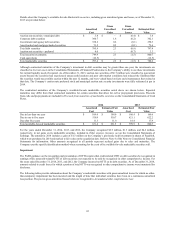

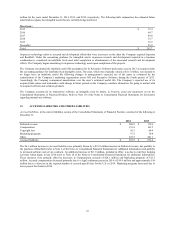

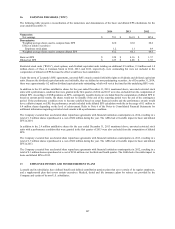

million for the years ended December 31, 2014, 2013, and 2012, respectively. The following table summarizes the estimated future

amortization expense for intangible assets that are currently being amortized.

Fiscal year:

2015 $ 73.4

2016 64.7

2017 49.0

2018 35.7

2019 16.9

Thereafter 23.0

Total $262.7

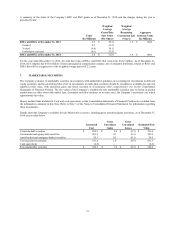

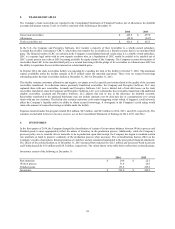

In-process technology refers to research and development efforts that were in process on the dates the Company acquired Saperion

and ReadSoft. Under the accounting guidance for intangible assets, in-process research and development acquired in a business

combination is considered an indefinite lived asset until completion or abandonment of the associated research and development

efforts. The Company begins amortizing its in-process technology assets upon completion of the projects.

The Company reevaluated the indefinite useful life assumption for its Perceptive Software trade name asset in 2013 as required under

the accounting guidance for indefinite-lived intangible assets. The asset, which was originally valued at $32.3 million, was deemed to

no longer have an indefinite useful life following changes in management’s expected use of the name as evidenced by the

centralization of the Company’s marketing organization across ISS and Perceptive Software during the fourth quarter of 2013.

Accordingly, the Company commenced amortization over the asset’s estimated useful life. The Company’s expected use of its

acquired trade names and trademarks could change in future periods as the Company considers alternatives for going to market with

its acquired software and solutions products.

The Company accounts for its internal-use software, an intangible asset by nature, in Property, plant and equipment, net on the

Consolidated Statements of Financial Position. Refer to Note 10 of the Notes to Consolidated Financial Statements for disclosures

regarding internal-use software.

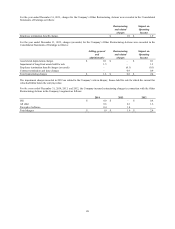

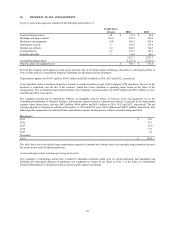

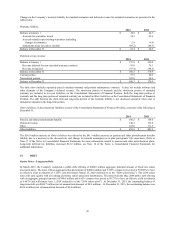

12. ACCRUED LIABILITIES AND OTHER LIABILITIES

Accrued liabilities, in the current liabilities section of the Consolidated Statements of Financial Position, consisted of the following at

December 31:

2014 2013

Deferred revenue $ 208.8 $ 175.0

Compensation 133.4 161.5

Copyright fees 56.3 64.0

Marketing programs 57.5 70.8

Other 222.5 201.1

Accrued liabilities $ 678.5 $ 672.4

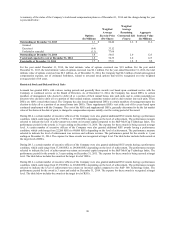

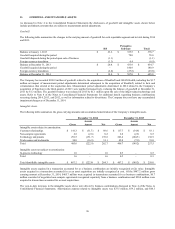

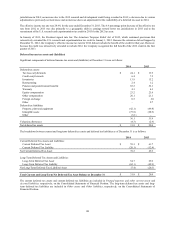

The $6.1 million increase in Accrued liabilities was primarily driven by a $33.8 million increase in Deferred revenue, due partially to

the purchase of ReadSoft (refer to Note 4 of the Notes to Consolidated Financial Statements for additional information) and partially

to increased software and service contracts. An additional increase of $11.8 million, included in Other, was due to cash flow hedging

activities which began in late 2014 (refer to Note 18 of the Notes to Consolidated Financial Statements for additional information).

These increases were partially offset by decreases in Compensation accruals of $28.1 million and Marketing programs of $13.3

million. Accrued compensation decreased primarily due to a legal settlement payout in 2014 of $14.4 million and approximately $16

million due to a decrease in the required number of accrued payroll days for the U.S. in 2014. Marketing programs decreased due to

lower payout for claims in 2014.

97