Lexmark 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

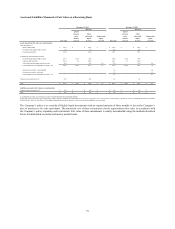

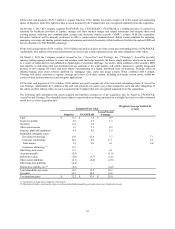

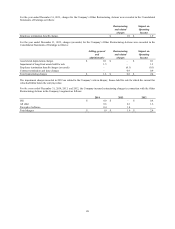

December 31, 2014 December 31, 2013

Carrying Unamortized Carrying Unamortized

Fair value Value discount Fair value value discount

2018 senior notes $ 334.0 $ 299.7 $ 0.3 $ 335.8 $ 299.6 $ 0.4

2020 senior notes 422.6 400.0 – 409.3 400.0 –

Total $ 756.6 $ 699.7 $ 0.3 $ 745.1 $ 699.6 $ 0.4

Refer to Note 13 of the Notes to Consolidated Financial Statements for additional information regarding the senior notes.

Plan Assets

Plan assets must be measured at least annually in accordance with accounting guidance on employers’ accounting for pensions and

employers’ accounting for postretirement benefits other than pensions. The fair value measurement guidance requires that the

valuation of plan assets comply with its definition of fair value, which is based on the notion of an exit price and the maximization of

observable inputs. The fair value measurement guidance does not apply to the calculation of pension and postretirement obligations

since the liabilities are not measured at fair value.

Refer to Note 17 of the Notes to Consolidated Financial Statements for disclosures regarding the fair value of plan assets.

Other Financial Instruments

The fair values of cash and cash equivalents, trade receivables and accounts payable approximate their carrying values due to the

relatively short-term nature of the instruments.

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis Subsequent to Initial Recognition

There were no material fair value adjustments to assets or liabilities measured at fair value on a nonrecurring basis subsequent to

initial recognition during 2014 or 2013.

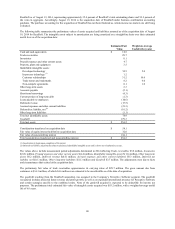

4. BUSINESS COMBINATIONS AND DIVESTITURES

Business Combinations

On January 2, 2015, subsequent to the date of the financial statements, the Company acquired substantially all the assets of Claron

Technology, Inc. (“Claron”). A leading provider of medical image viewing, distribution, sharing and collaboration software

technology, Claron’s solutions help healthcare delivery organizations provide universal access to patient imaging studies and other

content across and between healthcare enterprises.

The Company has begun its initial accounting for the purchase of Claron, and currently estimates the fair value of identifiable

intangible assets acquired to be approximately $17 million. This estimate is subject to change as the Company continues its accounting

for the purchase of Claron. Due to the limited amount of time since the acquisition the initial accounting for the acquisition is

incomplete. The Company intends to provide additional business combination disclosures including the amounts recognized as of the

acquisition date for other assets acquired and liabilities assumed, contingent consideration agreements and indemnification assets,

goodwill, and pro-forma results of the combined entity, if material, in its Quarterly Report on Form 10-Q for the first quarter of 2015.

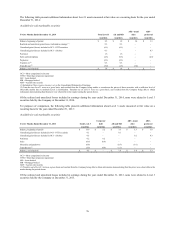

2014

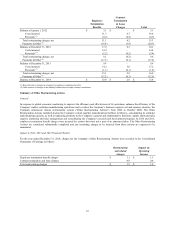

Acquisition of ReadSoft AB

In the second quarter of 2014, the Company commenced a public cash tender offer for all of the outstanding shares of ReadSoft AB

(“ReadSoft”). ReadSoft is a leading global provider of software solutions that automate business processes, both on premise and in the

cloud. Its software captures, classifies, sorts and routes both hard copy and digital business documents, provides approval workflows,

and automatically extracts and verifies relevant data before depositing it into a customer’s systems of record. With the addition of

ReadSoft, Perceptive Software will grow its software offering with additional document process automation capabilities and expand

its footprint in Europe.

Concurrent with the public tender offer, the Company also obtained shares in ReadSoft through multiple share purchase transactions

with specific shareholders in July 2014 and August 2014. On August 19, 2014, the Company purchased the ReadSoft founders’ share

holdings at a price of 57.00 Swedish kronor (SEK) per share. As a result of the purchases of the founders’ shares and the previous

purchases in the third quarter of 2014, the Company held a total of 1.2 million Class A shares and 9.7 million Class B shares in

79