LG 2004 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

LG ELECTRONICS ANNUAL REPORT 2004

096

097

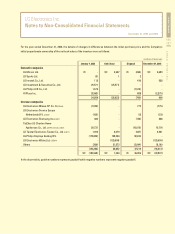

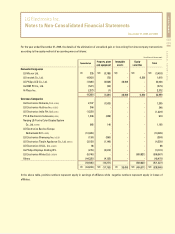

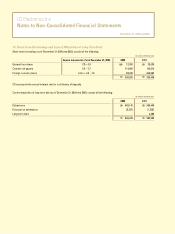

15. Debentures, Convertible Bonds and Long-Term Debt

Debentures and convertible bonds as of December 31, 2004 and 2003, consist of the following:

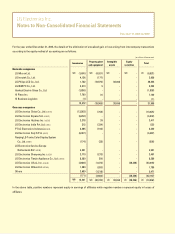

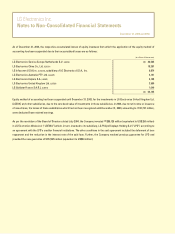

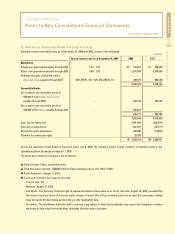

As per the resolution of the Board of Directors dated July 8, 2003, the Company issued foreign currency convertible bonds in the

Luxembourg Stock Exchange on August 11, 2003.

The terms and conditions of issuance are as follows:

Type of bonds : Public convertible bond

Total face value of bonds : US$287.5 million (fixed exchange rate of 1,179.2 : US$1)

Date of issuance : August 11, 2003

Terms and conditions for issuance of bonds

- Coupon rate : 0%

- Maturity : August 11, 2006

- Call option : The Company holds the right to redeem the bonds at face value on or at any time after August 12, 2005, provided that

the market value per share of common stock remains at least 115% of the conversion price for at least 20 consecutive trading

days during the 30-day trading period ending on the redemption date.

- Put option : The bondholder holds the right to exercise a put option, in which the bondholder may require the Company to redeem

the bonds at face value on the day after 18 months from the date of issuance.

Debentures

Private, non-guaranteed payable through 2006

Public, non-guaranteed payable through 2009

Floating rate notes of US $ 431 million

(2003:US $570 million) , payable through 2006

Convertible Bonds

Zero coupon rate convertible bonds of

US$ 287.5 million (2003 : US$ 287.5 million),

payable through 2006

Zero coupon rate convertible bonds of

US$ 250 million (2003:nil), payable through 2007

Less: Current maturities

Discount on debentures

Conversion rights adjustment

Premium for conversion rights

(in millions)

2004

126,000

2,070,000

449,878

2,645,878

339,796

296,975

636,771

3,282,649

(649,140)

(27,477)

(49,508)

37,092

2,593,616

Annual interest rate (%) at December 31, 2004

5.70 ~ 7.65

4.00 ~ 7.00

6M LIBOR + 0.5 ~1.25, 3M LIBOR+1.9

-

-

2003

306,000

2,090,000

682,746

3,078,746

339,796

-

339,796

3,418,542

(986,494)

(35,777)

(13,840)

-

2,382,431