LG 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

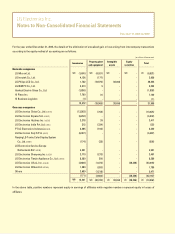

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

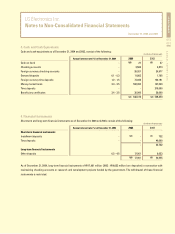

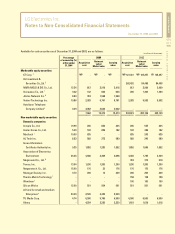

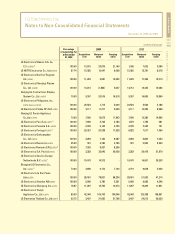

Overseas companies

Gemfire Corp. 7

Erlang Technology Inc. 1

Neopoint Inc. 1

E2OPEN.COM 1

COMMIT Incorporated

Monet Mobile Networks 1

SUNPOWER.INC

Others

Debt securities

Bonds issued by the government

Convertible bonds issued by

NeoDis Co., Ltd.

Commercial papers issued by

LG Card Co., Ltd

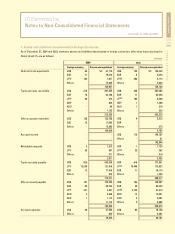

(in millions of Korean won)

-

-

-

-

4,990

-

1,257

507

27,617

27

2,204

19,062

21,293

64,383

2004

-

-

-

-

4,990

-

231

507

25,425

27

2,204

19,062

21,293

62,191

-

1,129

1,604

15,694

4,990

1,299

1,257

507

50,012

27

2,204

8,124

40,355

98,029

-

6.90

16.62

3.64

13.47

1.90

10.35

-

Percentage

of ownership (%)

at December

31,2004

Net asset

value/

Market value

Acquisition

cost

Carrying

value

-

1,129

-

15,694

4,990

1,299

1,257

507

43,499

856

2,204

-

3,060

246,668

2003

-

313

-

1,899

4,990

276

258

507

24,032

856

2,204

-

3,060

227,201

1,835

1,129

1,604

15,694

4,990

1,299

1,257

507

46,938

856

2,204

-

3,060

443,817

Net asset

value/

Market value

Acquisition

cost

Carrying

value

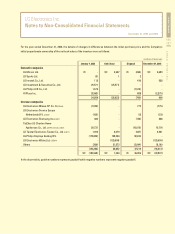

1. Carrying value was fully written down due to the negative net book value or bankruptcy of the investee company as of December 31, 2004.

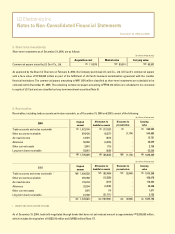

2. As approved by the Board of Directors on February 6, 2004, the Company purchased LG card Co., Ltd.

(LG Card)’s commercial papers with a face value of 150,000 million as part of the fulfillment of LG Card’s business

normalization agreement with the creditor financial institutions. Upon the agreement with the creditors,

the commercial papers of 38,124 million, classified as long-term investment securities, are scheduled to be converted to equity of

LG Card and the remaining commercial papers amounting to 111,876 million are scheduled to be collected within December 31, 2005.

The Company recognized an impairment loss of 41,437 million on the said commercial papers for the year ended December 31, 2004 (Note 5).

3. During 2004, the Company disposed of all the shares of KT Corp., resulting in a loss of 18,697 million.

4. During 2004, the Company newly purchased the investments.

5. As per the resolution of the Board of Directors dated December 23, 2003, the Company entrusted its disposal and voting rights

for the 10,180,531 shares of the common stock of LG Investment & Securities Co., Ltd. to Woori Bank, the representative of the creditor banks,

as a part of the business normalization plan of LG Card. In April 2004, in accordance with the business normalization plan,

Korea Development Bank exercised its preemptive right to purchase the shares of LG Investment & Securities Co., Ltd. Accordingly,

the Company disposed of all its 10,180,531 shares, resulting in a loss from disposal of investment securities of 51,696 million.

6. During 2004, all the investment in Megaround Co., Ltd. were exchanged to investment in Jindoo Network Inc.,

marketable security because Megaround Co., Ltd. was merged by Jindoo Network Inc.

Gain on valuation of investment in Jindoo Network Inc. amounting to 1,250 million was recorded as capital adjustments.

7. During 2004, the Company disposed of the investments, resulting in gain on disposal of investment securities of 487 million.