LG 2004 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

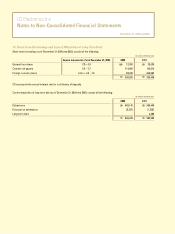

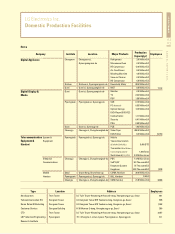

21. Capital Adjustments

Capital adjustments as of December 31, 2004 and 2003, consist of the following:

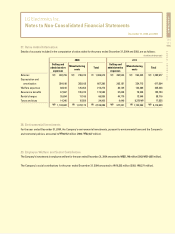

The Company has retained treasury stocks consisting of 793,208 shares (2003 : 194,953 shares) of common stock and 4,680 shares

(2003 : 4,678 shares) of preferred stock as of December 31, 2004. The Company intends to either grant these treasury stocks to

employees and directors as compensation, or to sell them in the future.

Treasury stock

Gain on valuation of equity method investment securities

Gain (loss) on (from) valuation of available-for-sale securities

Loss from disposal of treasury stock

(in millions of Korean won)

2004

(46,657)

299,877

7,812

-

261,032

2003

(8,977)

163,609

(92,012)

(62)

62,558

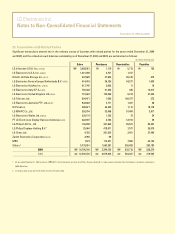

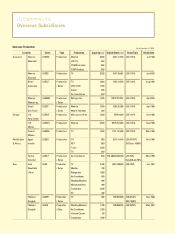

The reconciliations from income before income taxes to taxable income for the years ended December 31, 2004 and 2003, are as

follows: (in millions of Korean won)

2004

1,860,126

(34,646)

61,675

38,270

(1,180,816)

61,694

(30,080)

41,652

817,875

(67,202)

750,673

Income before income taxes

Temporary differences:

Allowance for doubtful accounts

Product warranty reserve

Amortization of intangible assets

Equity method investment securities

Deferred income of investment securities

Duty drawback

Others

Permanent differences

Taxable income

2003

836,800

(80,514)

4,782

53,122

(448,201)

302,506

(25,471)

76,046

719,070

32,307

751,377

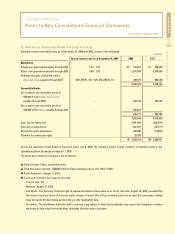

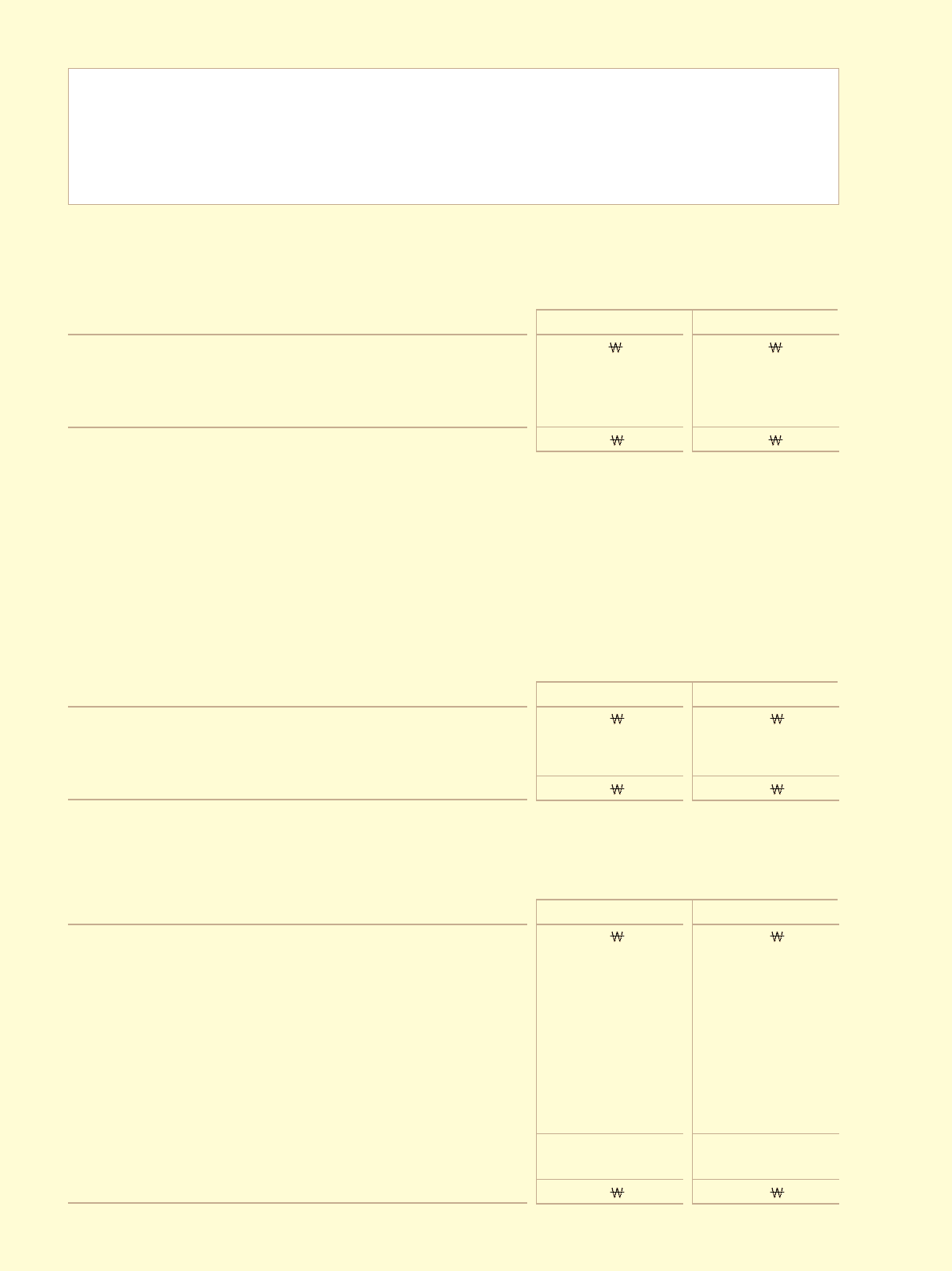

22. Income Taxes

Income tax expense for the years ended December 31, 2004 and 2003, are as follows:

Current income taxes

Deferred income taxes

Income taxes added to shareholders’ equity

Income tax expense

(in millions of Korean won)

2004

146,352

144,963

22,857

314,172

2003

185,718

(17,557)

5,815

173,976