LG 2004 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

LG ELECTRONICS ANNUAL REPORT 2004

106

107

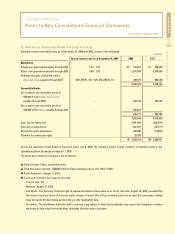

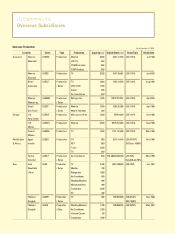

24. Dividends

Details of dividends declared for the years ended December 31, 2004 and 2003, are as follows:

Common stock

Preferred stock

(in millions of Korean won)

Dividend ratio (%)

25%

26%

2004 2003

Dividend amount

174,264

22,336

196,600

Dividend ratio (%)

30%

31%

Dividend amount

208,220

26,631

234,851

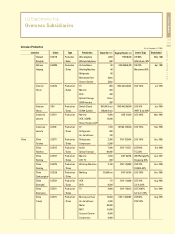

The Company’s dividend payout ratio for the years ended December 31, 2004 and 2003, is computed as follows:

The Company’s dividend yield ratio for the years ended December 31, 2004 and 2003, is computed as follows:

Dividend per share (A)

Market price as of

balance sheet date (B)

Dividend yield ratio ((A)/(B))

(in Korean won)

Common stock

1,250

58,600

2.13%

2004 2003

Preferred stock

1,300

25,950

5.01%

Common stock

1,500

64,100

2.34%

Preferred stock

1,550

36,000

4.31%

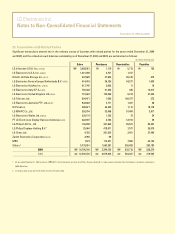

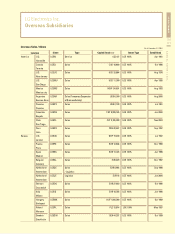

The diluted securities outstanding as of December 31, 2004, are as follows:

(in millions of Korean won, except per share amounts)

Total dividends (A)

Net income (B)

Dividend payout ratio ((A)/(B))

(in millions of Korean won, except for ratios)

2004

234,851

1,545,954

15.19%

2003

196,600

662,824

29.66%

Diluted security

Foreign currency denominated

convertible bonds, issued in 2003

Foreign currency denominated

convertible bonds, issued in 2004

Face value

339,796

(US$287.5)

296,975

(US$250.0)

Conversion period

September 12, 2003

through July 28, 2006

May 18, 2005

through May 7, 2007

Number of shares

of common

stock to be issued

4,920,464 shares

3,049,221 shares

Conversion price

68,900

per share

96,869

per share