LG 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG ELECTRONICS ANNUAL REPORT 2004

030

031

Digital Media Division sales in 2004

recorded KRW 3.8 trillion, a 7% decrease from the

previous year. This is mostly due to our withdrawal

from the PC OEM business. Even though our

revenues went down, our operating profit

increased from the previous year with a 4.6%

margin. This is an indicator of our continued focus

on profit-oriented business in the Division.

The introduction of new products ahead

of competitors allowed us to achieve the No.1

market share in 2004 in all kind of optical storage

products including the DVD writers market

traditionally dominated by Japanese makers. These

efforts have allowed us to sustain a leadership

position in the world's optical storage markets for

the past seven years.

In the AV business field, our home

theaters accquired the world number one market

share in 2004. We have also enjoyed great success

in developing technological advancements,

creating a next-generation HD recorder for the first

time in Korea, and launching the world's first DVD

Recorders with built-in HDD/STB. We have also

placed a strong emphasis on the Telematics

business, a new growth engine, and will continue

to bolster our leading position in that market, both

at home and abroad.

We restructured our PC business,

reducing the low profitability of PC OEM business,

and implementing an aggressive brand marketing

program. As a result, our domestic market share in

PCs increased to 14% in 2004, compared to the

3% of 2003. In addition, our mobile device

business has grown remarkably driven by a close

partnership with Hewlett Packard. This paves the

way for our becoming a number one supplier to

global mobile device markets.

The economic uncertainties in Korea

caused by a slow-down in domestic consumption,

and an Korean won's appreciation, are expected to

continue in 2005. Our Digital Media Division will

keep growing based on our augmentation of

aggressive marketing activities, and the launching

of new products.

The size of the optical storage market in

2005 is expected to be 250 million units, a 4%

increase over the previous year with the DVD Writer

continuously positioning as a mainstream product

in this market. Sales of slim DVD Writers are

expected to continue growing. Mindful of this, we

will put forth our best efforts to extend our sales of

these products into global markets. With speed

competition being over, we believe product price

will be a crucial factor for success in 2005, and so

Recorder Combi Home Theater LH-RC9500TA

The world's first ±R/RW multi DVD recorder and 6HD HiFi

VCR combi home theater / 1200W high capacity, installed

sound improvement technology called XTS pro / Recording

DVD up to six hours with 4.7GB disc / Adopting IEEE 1394 DV

input, 7 in 2 multi memory slot

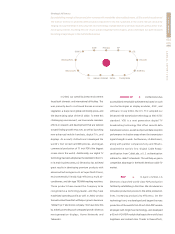

03 04

0.5 3.8

0.4 4.1

3.3

3.7

03 04

173

174

1Q 2Q 3Q 4Q

1.0

0.9

0.9

1.0

Sales

(in trillions of Korean won)

■Domestic

■Export

Operating Profit

(in billions of Korean won)

Quarterly Sales

(in trillions of Korean won)